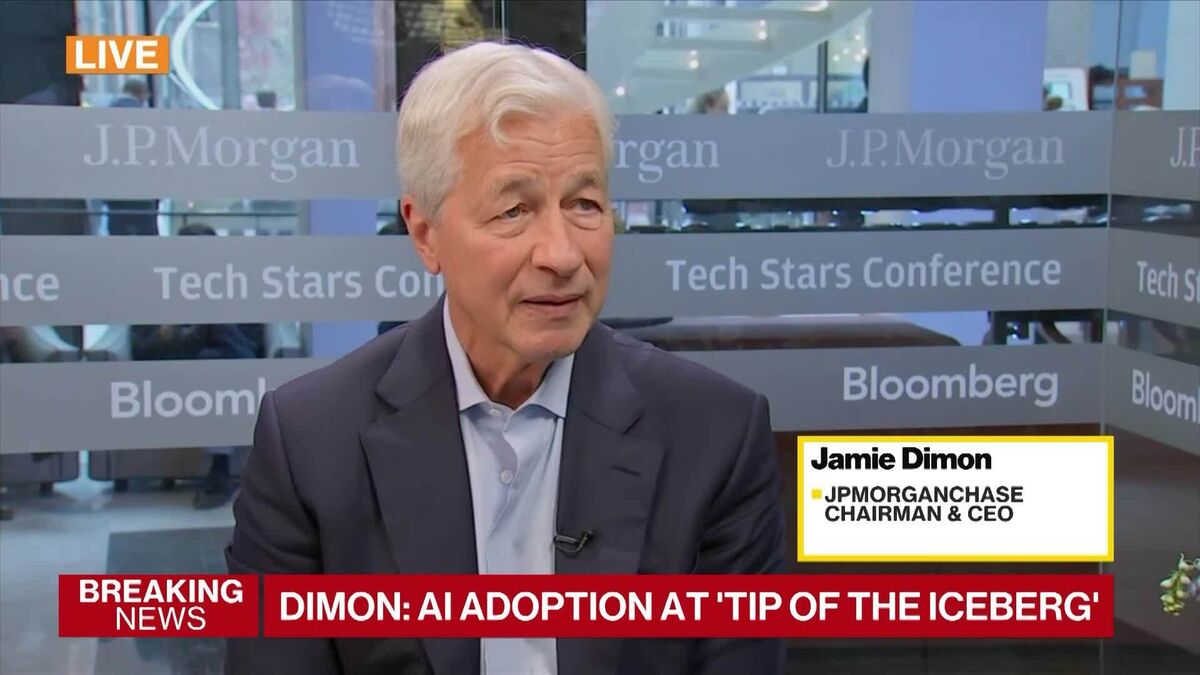

Dimon Says AI Adoption Is at the ‘Tip of the Iceberg’

PositiveFinancial Markets

Jamie Dimon, the CEO of JPMorgan Chase, recently highlighted the company's significant investment in artificial intelligence, spending around $2 billion annually. This investment not only drives innovation but also saves the company an equivalent amount each year. Dimon's insights during his interview on Bloomberg Tech emphasize the growing importance of AI in the financial sector, suggesting that we are just beginning to see its potential impact.

— Curated by the World Pulse Now AI Editorial System