Dow Jones, Nasdaq, S&P 500 weekly preview: Tesla, Netflix to report ahead of CPI

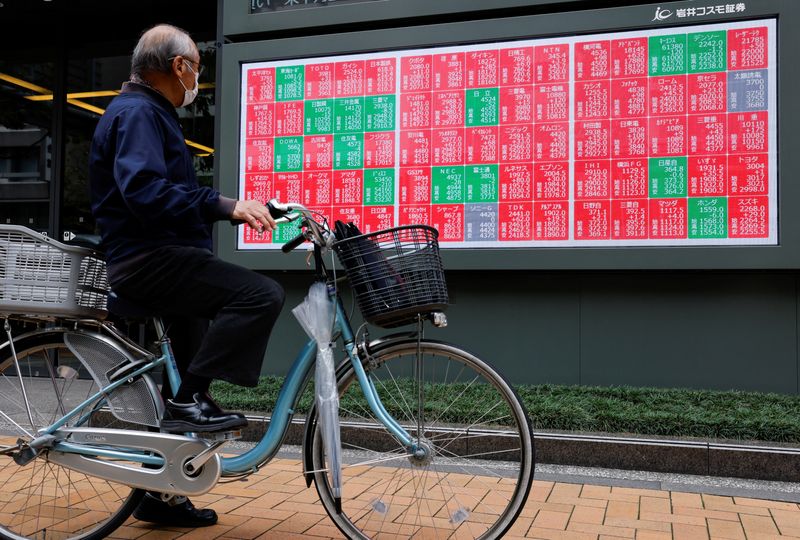

NeutralFinancial Markets

This week, investors are keeping a close eye on the Dow Jones, Nasdaq, and S&P 500 as major companies like Tesla and Netflix prepare to report their earnings. These reports are crucial as they can influence market trends and investor sentiment, especially ahead of the upcoming Consumer Price Index (CPI) data release. Understanding how these companies perform can provide insights into the overall health of the economy.

— Curated by the World Pulse Now AI Editorial System