Big Banks Credit ‘Resilient’ Economy for Profit Growth

PositiveFinancial Markets

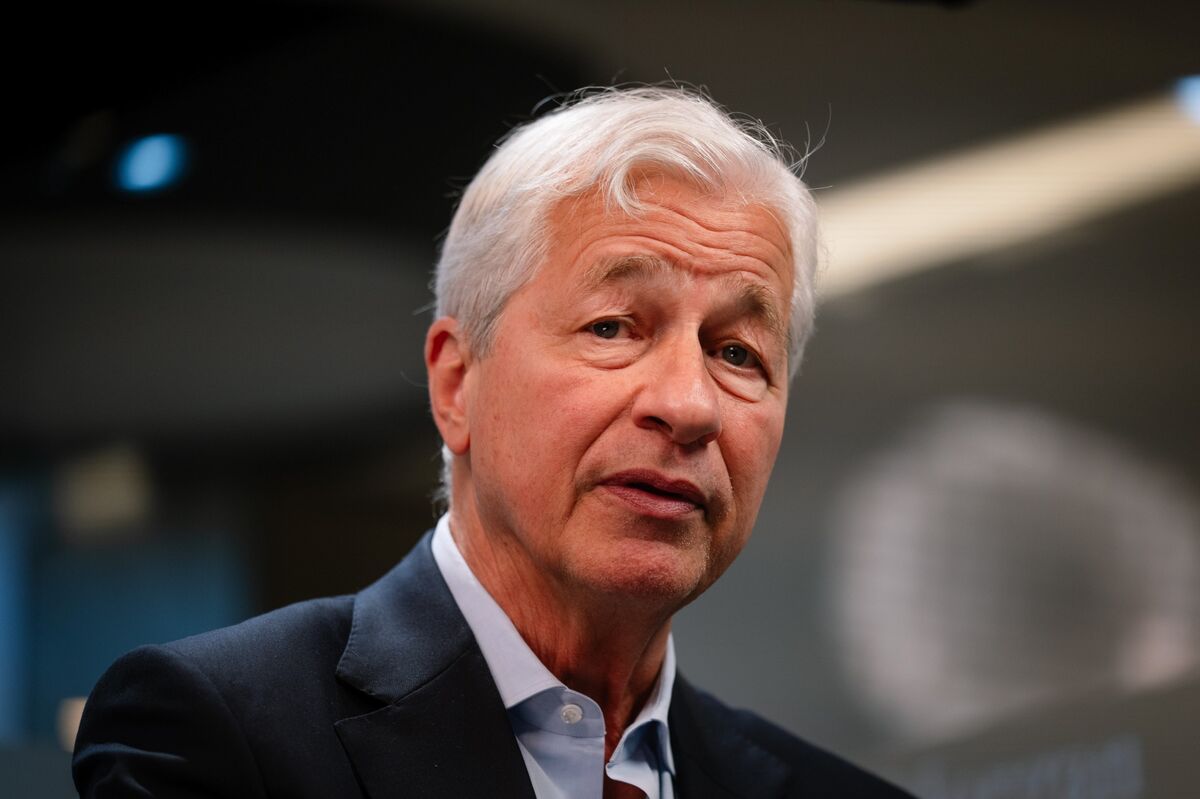

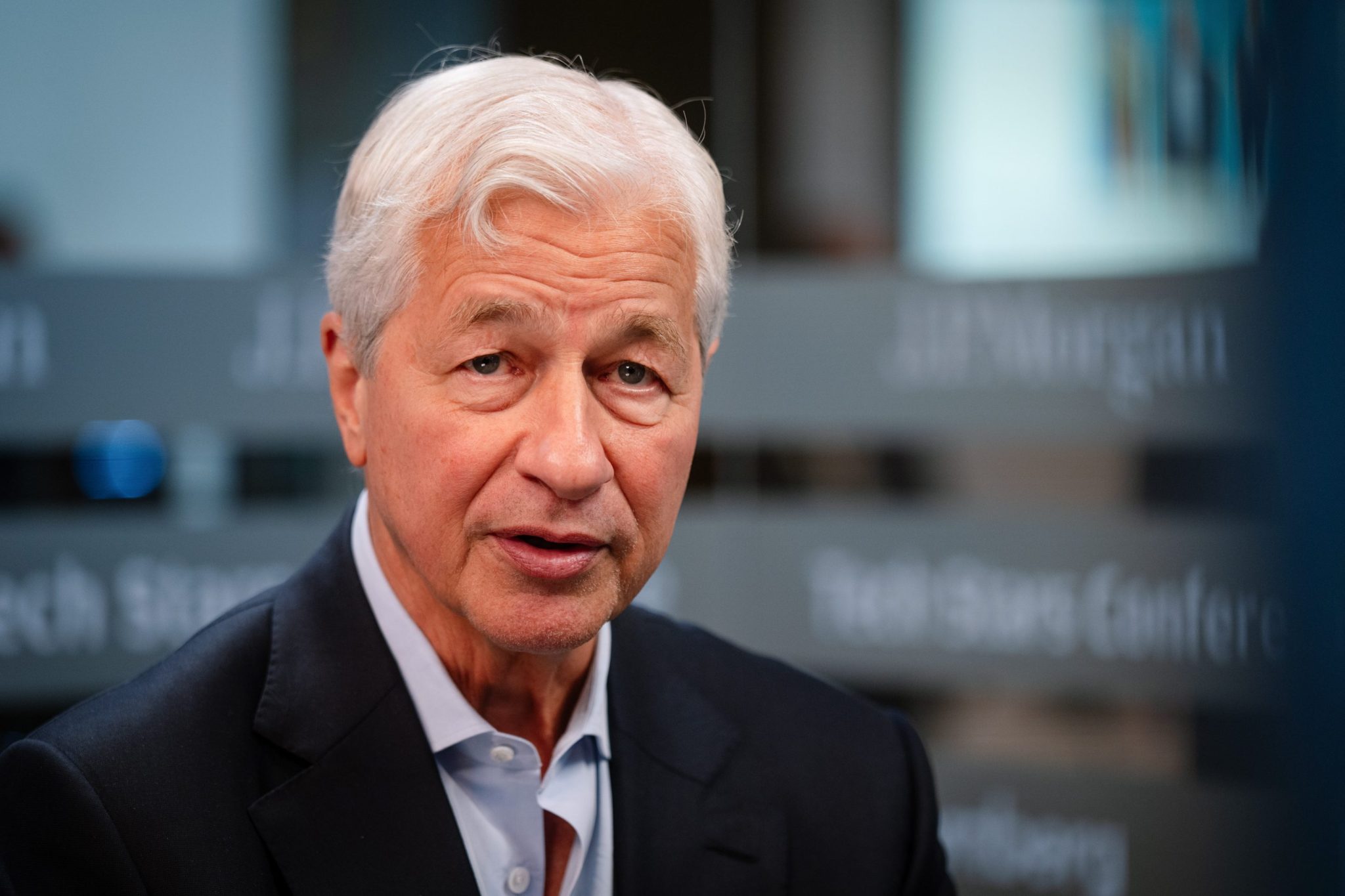

Big banks like JPMorgan Chase, Goldman Sachs, Citi, and Wells Fargo are celebrating strong earnings, surpassing analyst expectations and showcasing broad growth. Jamie Dimon highlighted the resilience of the U.S. economy in a recent earnings release, indicating that despite challenges, the financial sector is thriving. This positive trend not only reflects the banks' robust performance but also suggests a stable economic environment, which is crucial for investor confidence and future growth.

— Curated by the World Pulse Now AI Editorial System