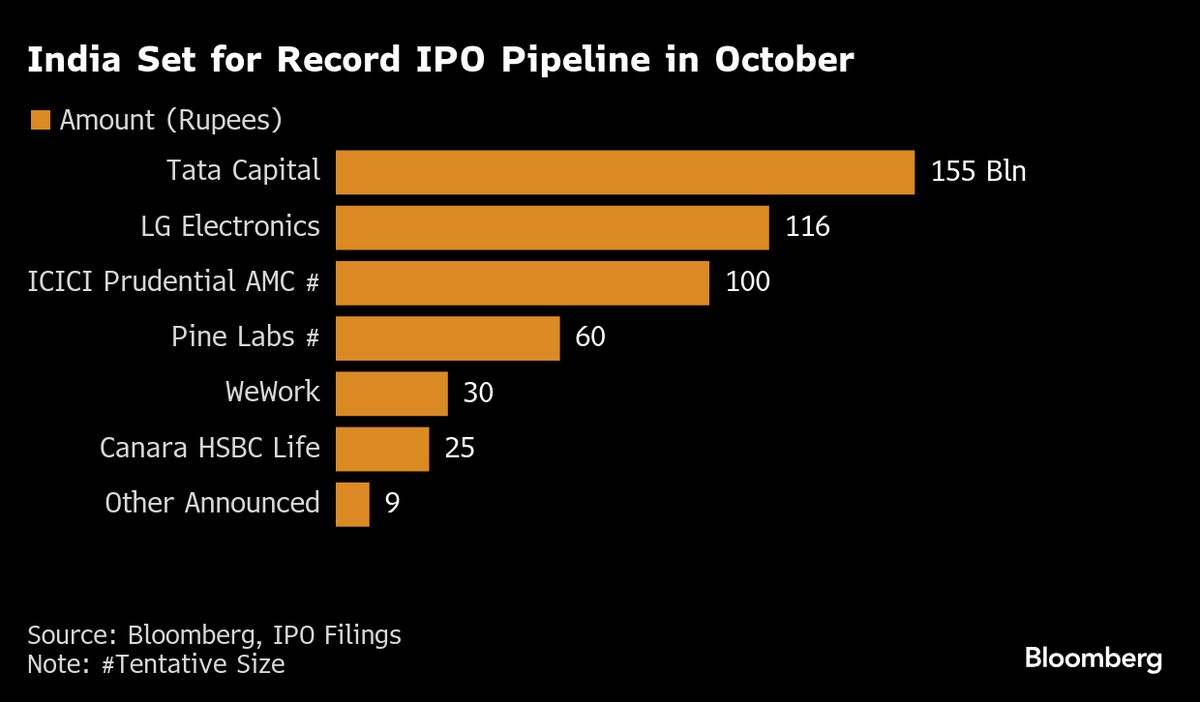

Indian IPOs May Hit Record $5 Billion in October Even as Listed Equities Wobble

PositiveFinancial Markets

Indian IPOs are on track to potentially reach a record $5 billion in October, showcasing a robust market despite some fluctuations in listed equities. This surge in initial public offerings is significant as it reflects investor confidence and could lead to increased capital flow into the economy, making it an exciting time for both companies and investors.

— Curated by the World Pulse Now AI Editorial System