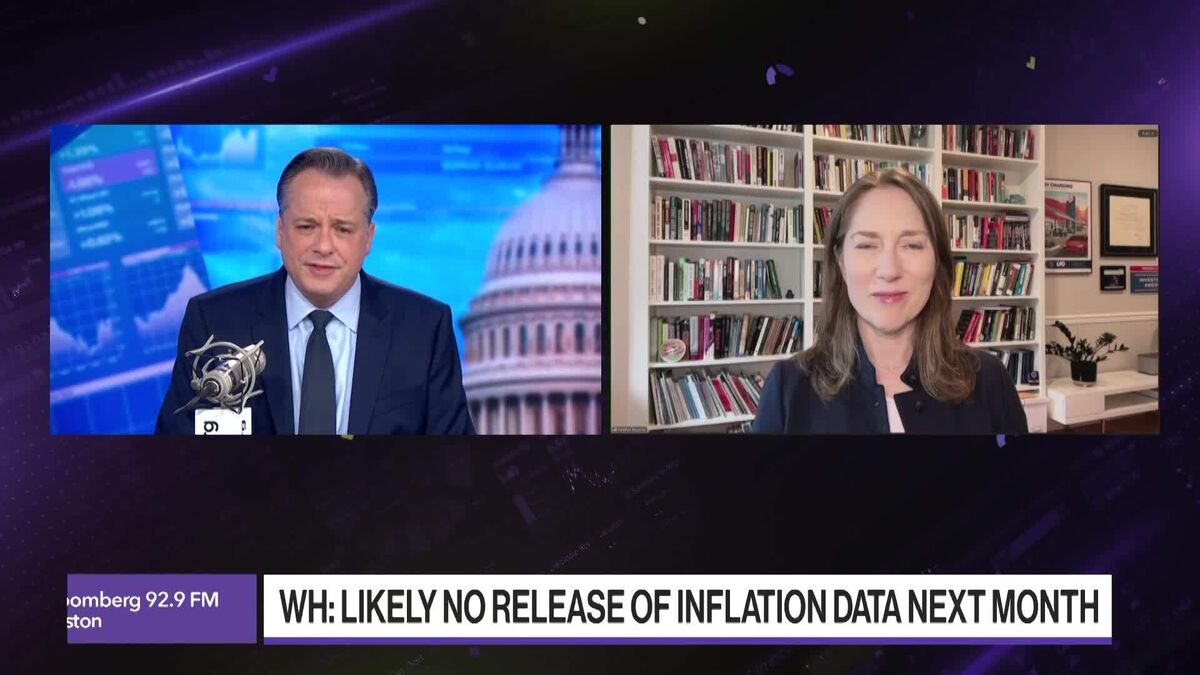

White House Says October Price Data Unlikely to Be Released

NegativeFinancial Markets

The White House has announced that it will not release crucial economic data for October, leaving economists feeling 'flying blind' amid an ongoing government shutdown. This decision raises concerns about transparency and the ability to assess the economic landscape, which is vital for informed decision-making by businesses and policymakers. Without this data, understanding the current economic situation becomes increasingly challenging, potentially impacting financial markets and economic planning.

— Curated by the World Pulse Now AI Editorial System