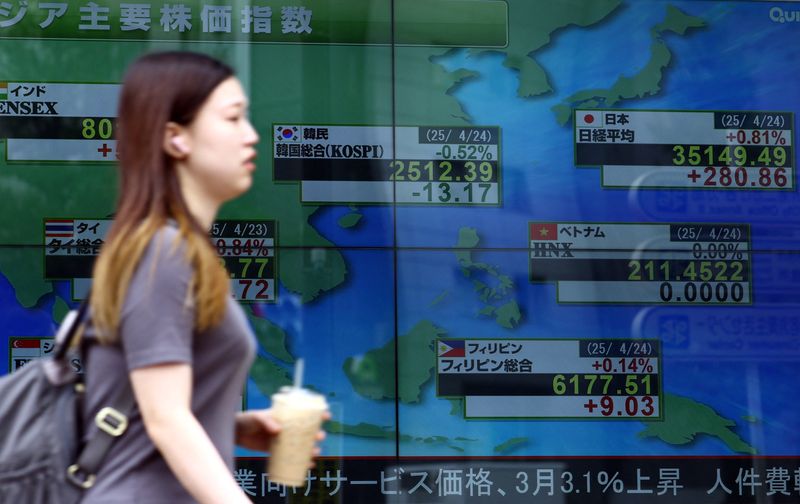

Asian shares, gold rise on US shutdown watch; crude falls

NeutralFinancial Markets

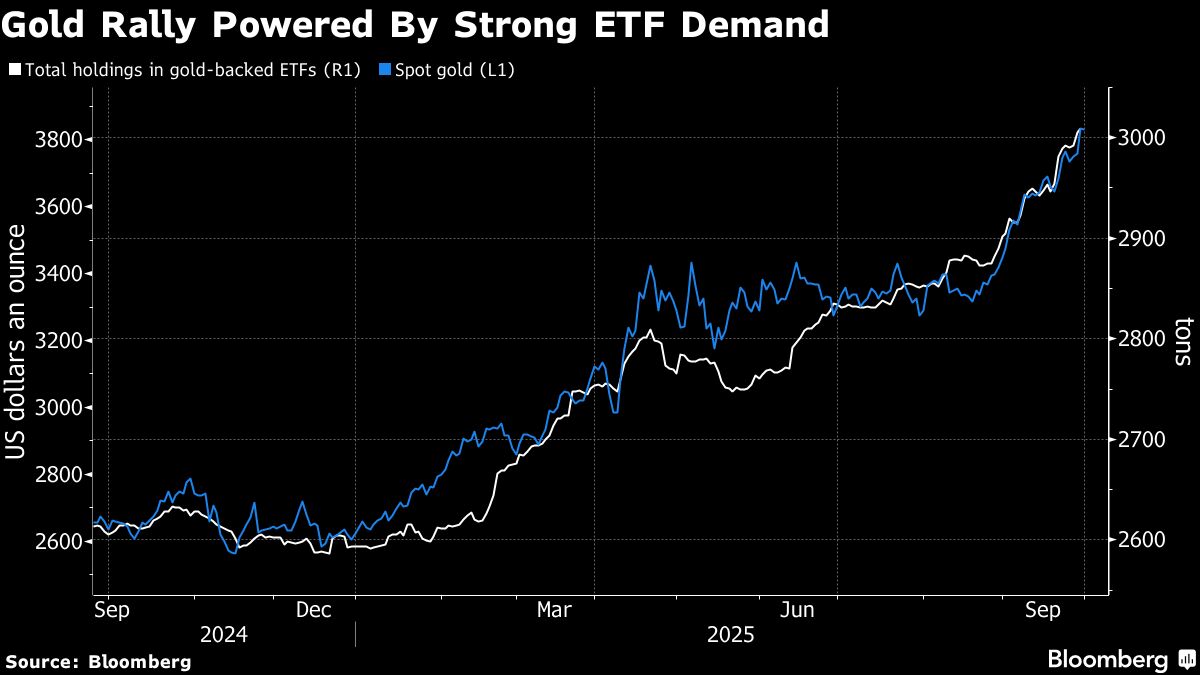

Asian shares and gold prices have seen an uptick as investors keep a close eye on the potential for a US government shutdown, which could have significant economic implications. Meanwhile, crude oil prices are experiencing a decline. This situation highlights the interconnectedness of global markets and the impact of political events on financial stability.

— Curated by the World Pulse Now AI Editorial System