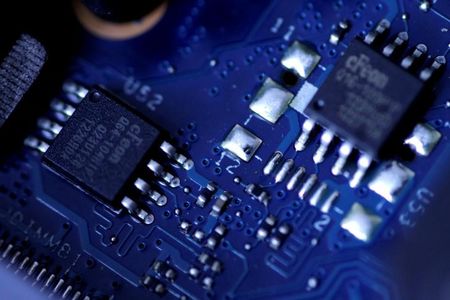

Trump considering electronics tariffs based on chip content- Reuters

NeutralFinancial Markets

Former President Donald Trump is reportedly contemplating the implementation of tariffs on electronics, which would be determined by the chip content of the products. This move could significantly impact the electronics market and international trade relations, as it may lead to increased costs for consumers and manufacturers alike. Understanding the implications of such tariffs is crucial for stakeholders in the tech industry.

— Curated by the World Pulse Now AI Editorial System