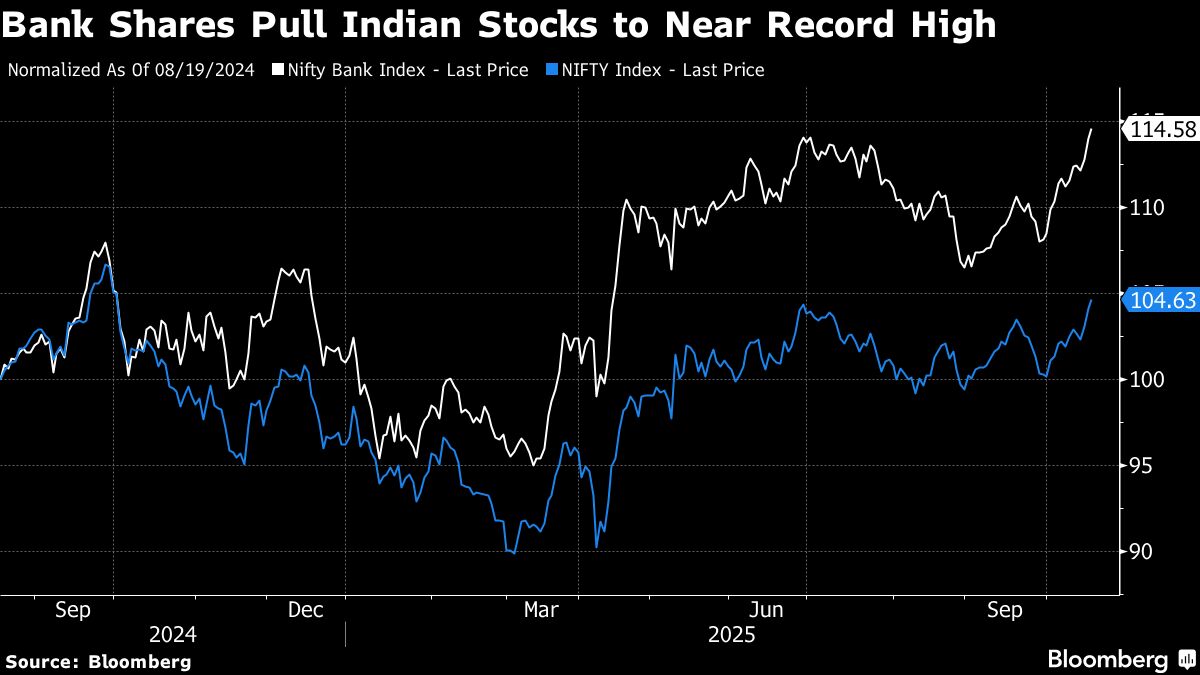

Global Banks Bet Billions on India Deals Amid US Credit Jitters

PositiveFinancial Markets

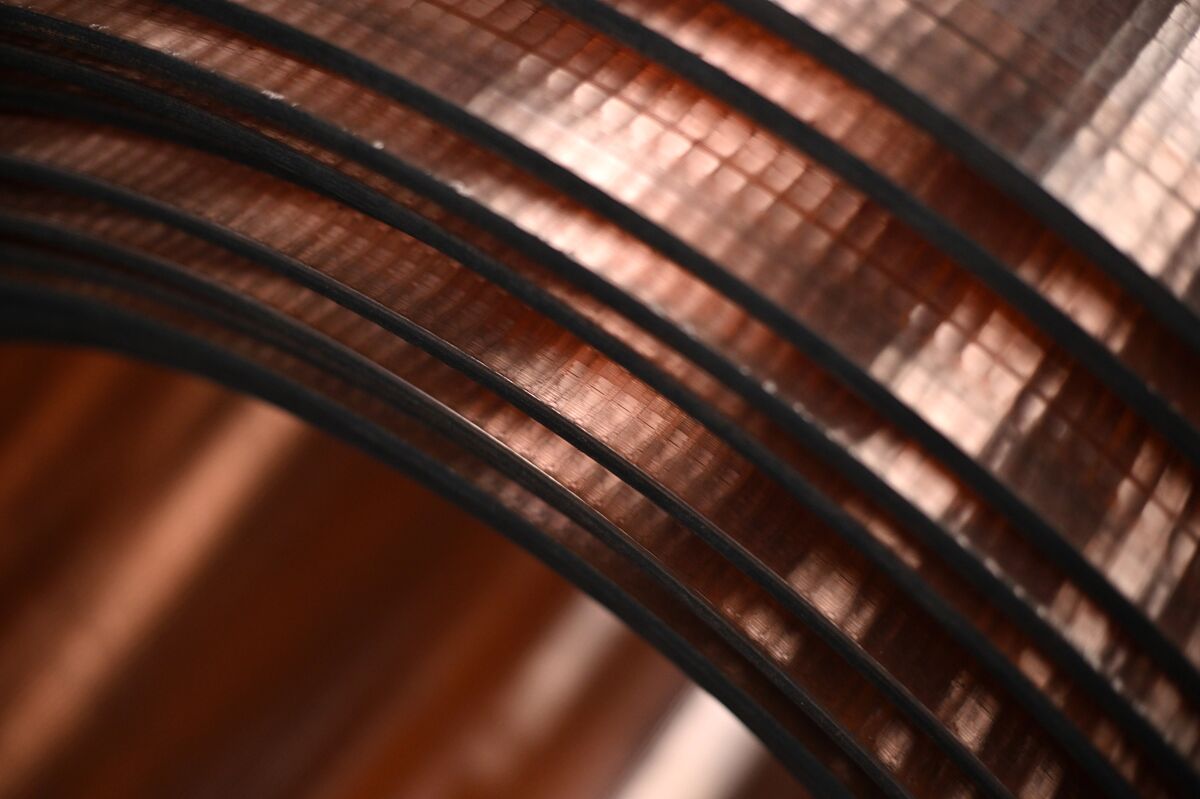

Indian banks are making headlines as global financial institutions invest billions in the country's financial sector. This surge in investment comes at a crucial time when US credit losses and trade tensions are causing uncertainty among investors worldwide. The focus on India highlights its growing importance in the global economy and presents opportunities for growth and stability in the region.

— Curated by the World Pulse Now AI Editorial System