CenterPoint Energy stock price target raised to $41 by BMO Capital

PositiveFinancial Markets

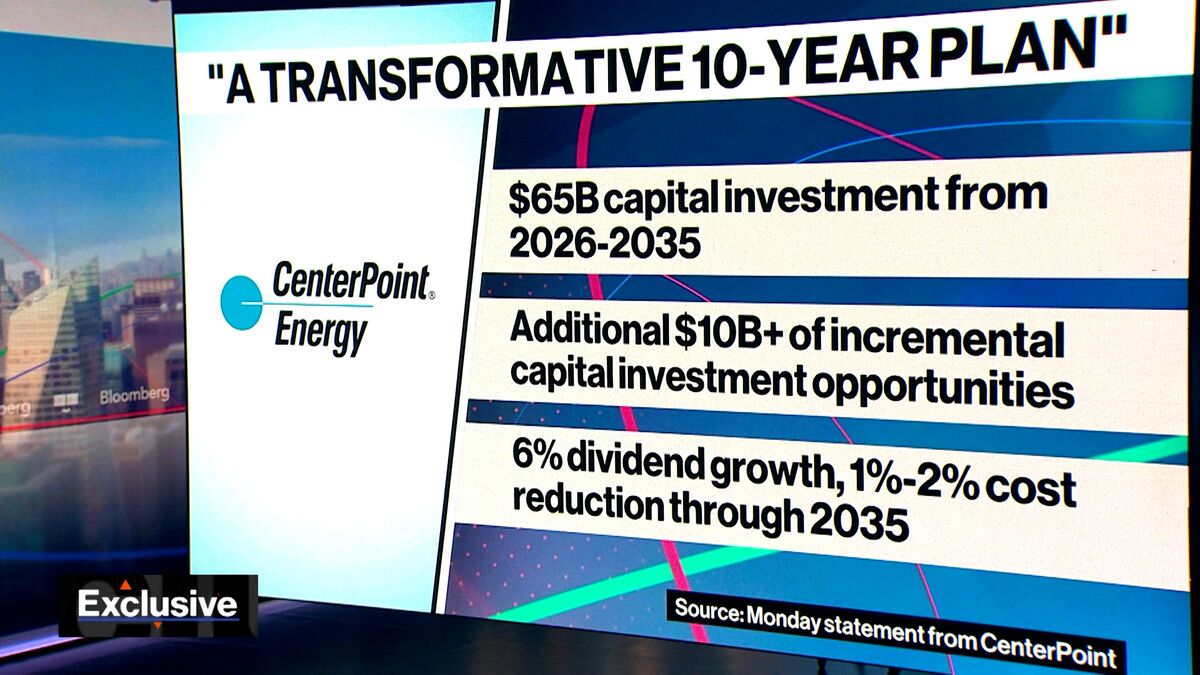

BMO Capital has raised its price target for CenterPoint Energy's stock to $41, reflecting confidence in the company's growth potential. This adjustment is significant as it indicates a positive outlook for investors, suggesting that CenterPoint is well-positioned in the energy market. Such upgrades can influence investor sentiment and potentially lead to increased trading activity, making it an important development for those following the stock.

— Curated by the World Pulse Now AI Editorial System