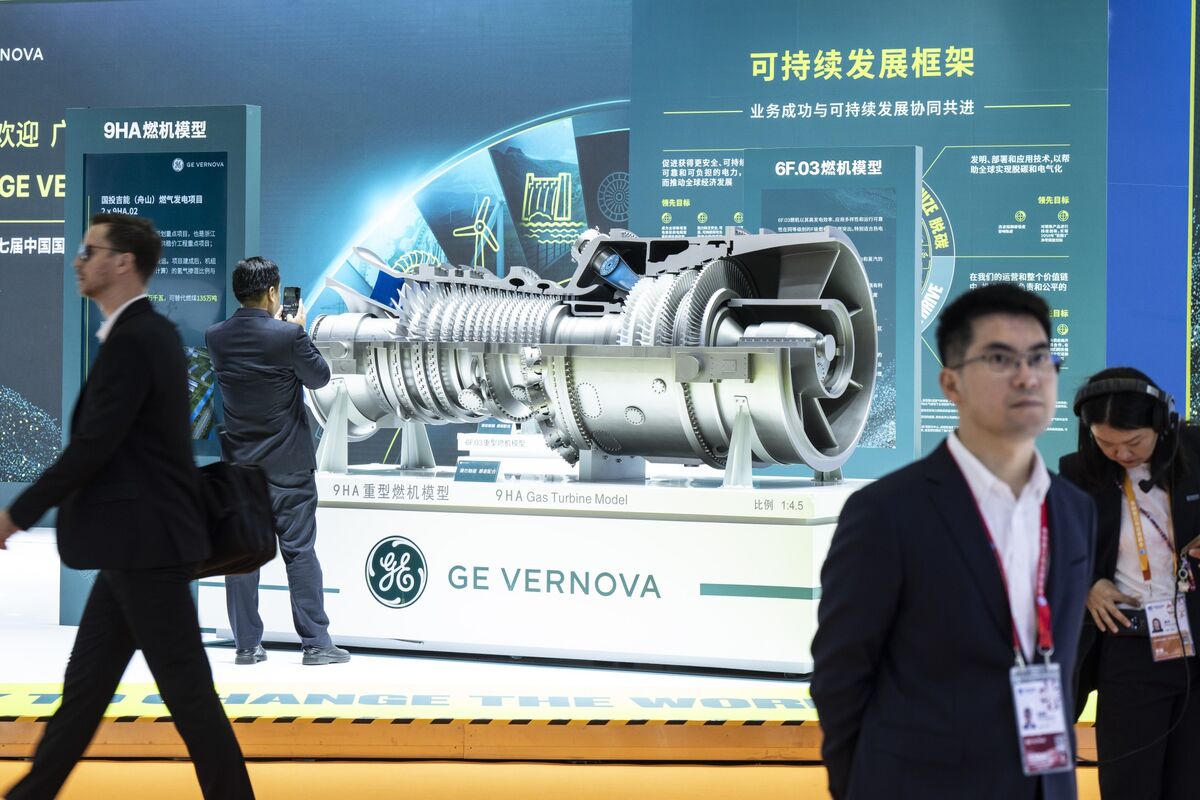

GE Vernova Swings to Profit as Orders Soar

PositiveFinancial Markets

GE Vernova has reported a significant profit in the third quarter, driven by a remarkable increase in orders for its power and electrification sectors. This turnaround is crucial as it highlights the company's ability to capitalize on growing demand in the energy market, positioning itself for future growth and stability.

— Curated by the World Pulse Now AI Editorial System