Anduril Looks to Onshore Its Supply Chain

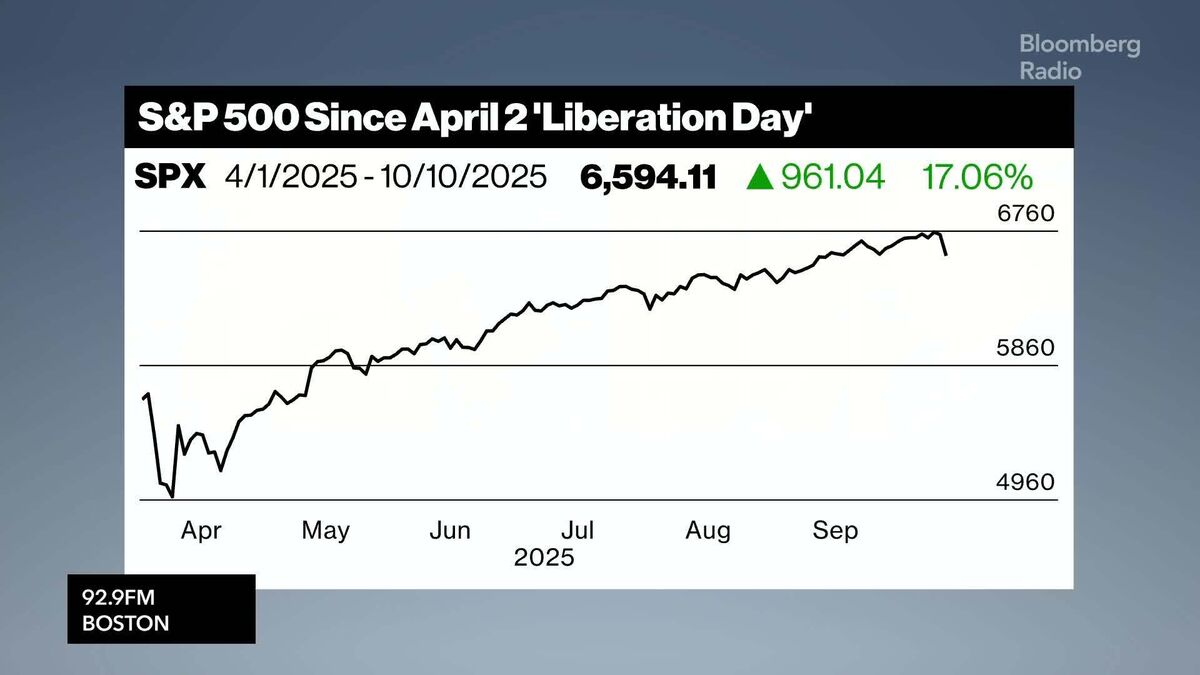

PositiveFinancial Markets

Anduril's CEO Brian Schimpf has emphasized the importance of strengthening the US manufacturing sector in light of potential new tariffs on China proposed by President Donald Trump. This move not only aims to mitigate risks associated with overseas supply chains but also highlights a growing trend towards domestic production, which could bolster the US economy and create jobs. Schimpf's insights on Bloomberg Tech shed light on the strategic shifts companies are making to adapt to changing trade policies.

— Curated by the World Pulse Now AI Editorial System