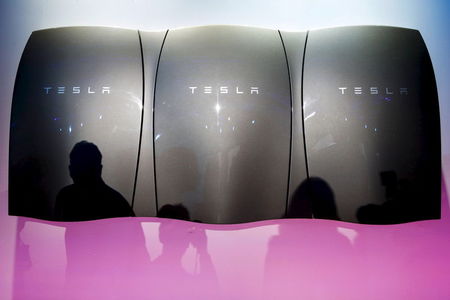

IBM, Tesla Slide Among Thursday’s Market Cap Stock Movers

NegativeFinancial Markets

On Thursday, both IBM and Tesla experienced significant declines in their market capitalization, reflecting broader concerns in the tech sector. This downturn is noteworthy as it highlights the volatility of tech stocks and the potential impact on investor confidence. As these companies are key players in their respective fields, their performance can influence market trends and investor sentiment.

— Curated by the World Pulse Now AI Editorial System