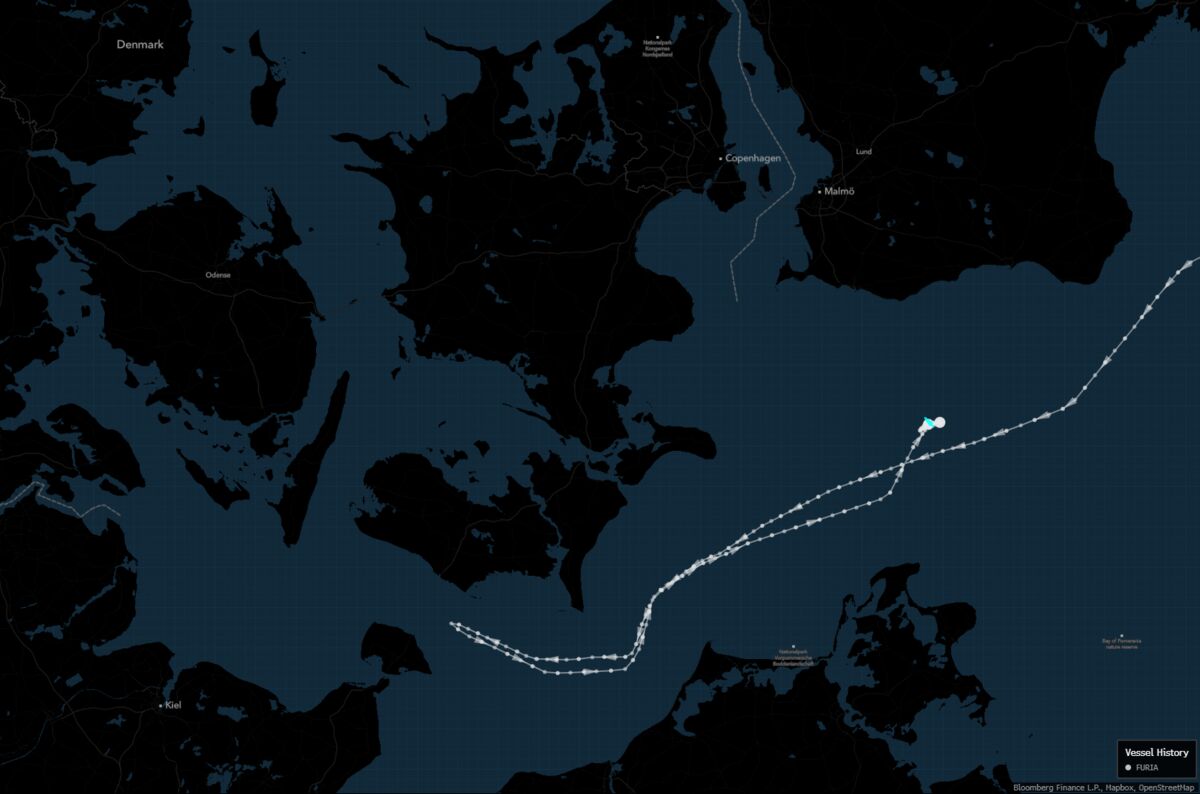

India-Bound Tanker Carrying Russian Crude U-Turns in Baltic Sea

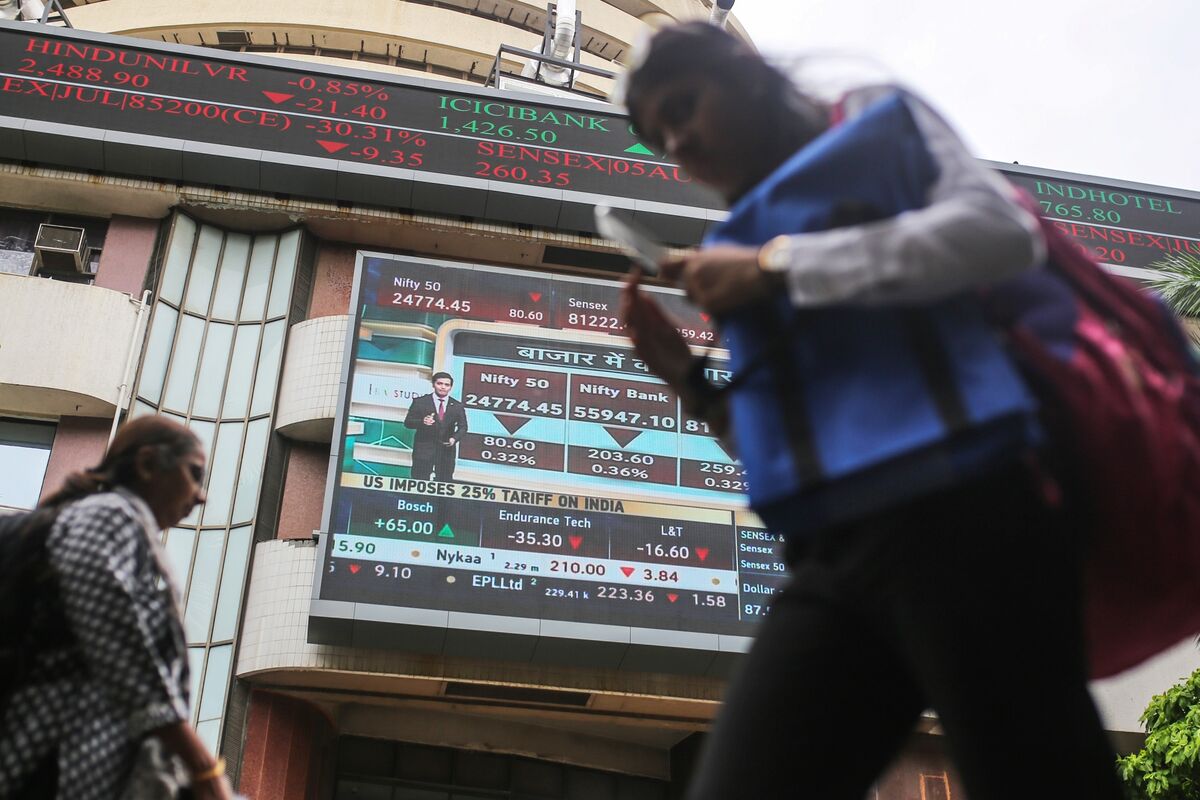

NegativeFinancial Markets

A tanker carrying Russian crude oil destined for India has unexpectedly reversed its course and is now idling in the Baltic Sea. This development raises concerns about potential disruptions in the oil trade between India and Russia, especially following the recent tightening of US sanctions on Moscow. The situation highlights the complexities of global oil supply chains and the impact of geopolitical tensions on energy markets.

— Curated by the World Pulse Now AI Editorial System