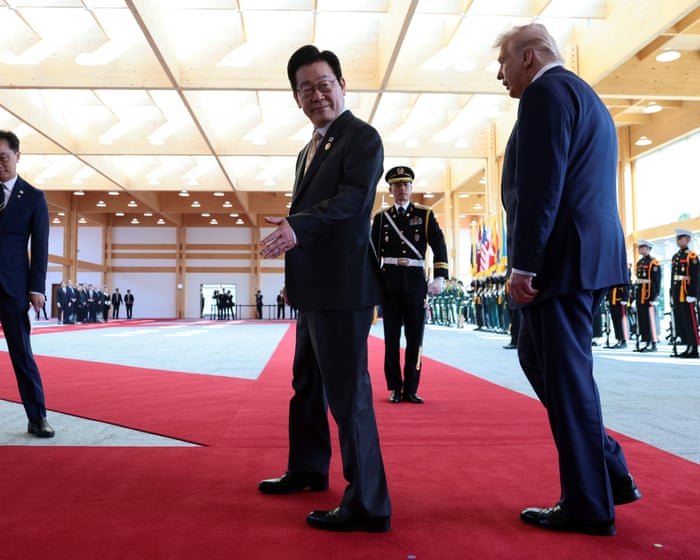

Could US trade deals push ASEAN countries into the arms of China?

NegativeFinancial Markets

The recent ASEAN summit highlighted several trade deals favoring the US, raising concerns that these lopsided agreements might push Southeast Asian countries closer to China. As China strengthens its trade ties in the region, analysts worry that the US's approach could backfire, potentially alienating ASEAN nations. This situation is critical as it not only affects economic relations but also geopolitical dynamics in Asia. Additionally, the summit coincided with France's National Assembly passing a corporate tax extension and the looming threat of a US government shutdown, which could impact vital social services.

— Curated by the World Pulse Now AI Editorial System