Stocks Hold Gains As Shutdown Worries Linger | Closing Bell

NeutralFinancial Markets

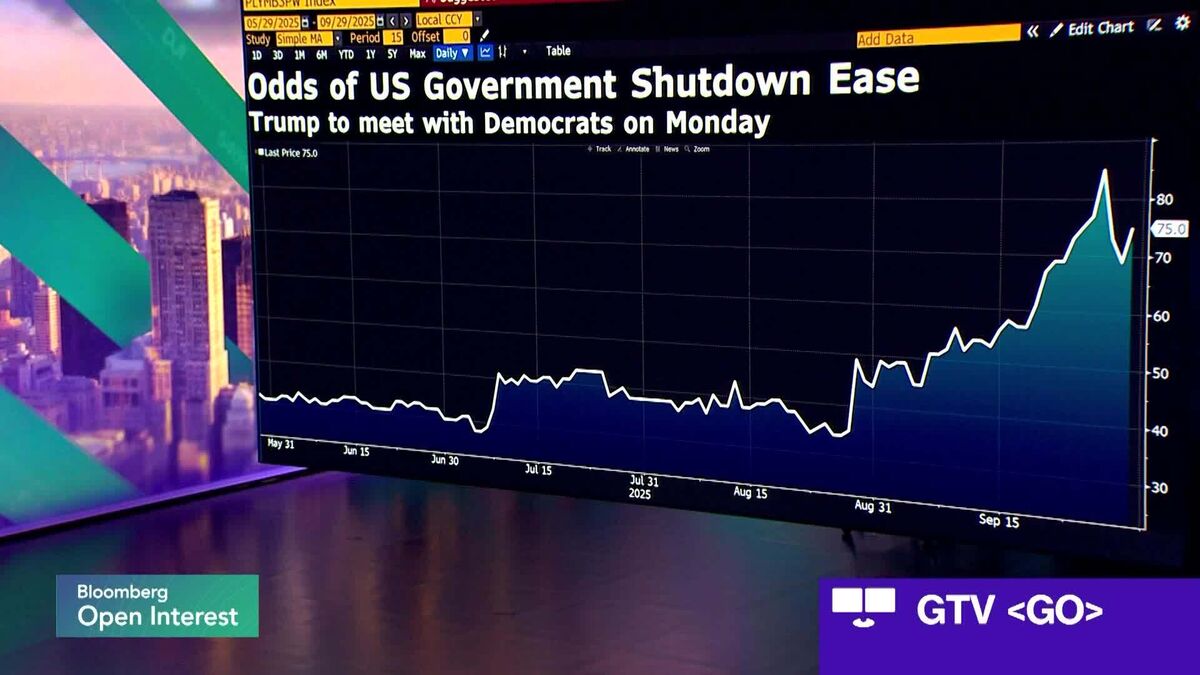

Stocks managed to hold onto their gains despite ongoing concerns about a potential government shutdown. This is significant as it reflects investor resilience and market stability in the face of uncertainty. The coverage by Bloomberg Television, Radio, and YouTube provides insights into how these developments are impacting the U.S. market.

— Curated by the World Pulse Now AI Editorial System