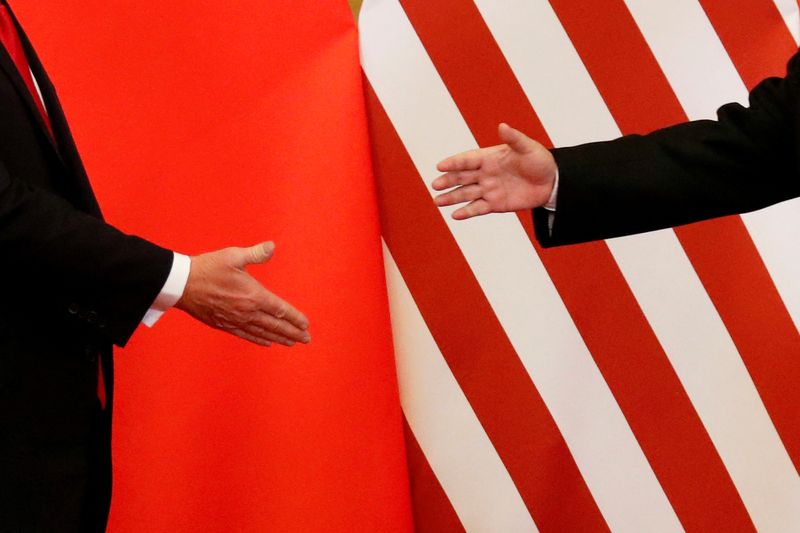

Wall St futures climb on expected Fed easing, US-China trade progress

PositiveFinancial Markets

Wall Street futures are on the rise as investors anticipate easing measures from the Federal Reserve and positive developments in US-China trade relations. This optimism is significant as it suggests a potential boost to the economy, encouraging market confidence and investment. The expected Fed easing could lower borrowing costs, making it easier for businesses and consumers to spend, while progress in trade talks may alleviate uncertainties that have weighed on the market.

— Curated by the World Pulse Now AI Editorial System