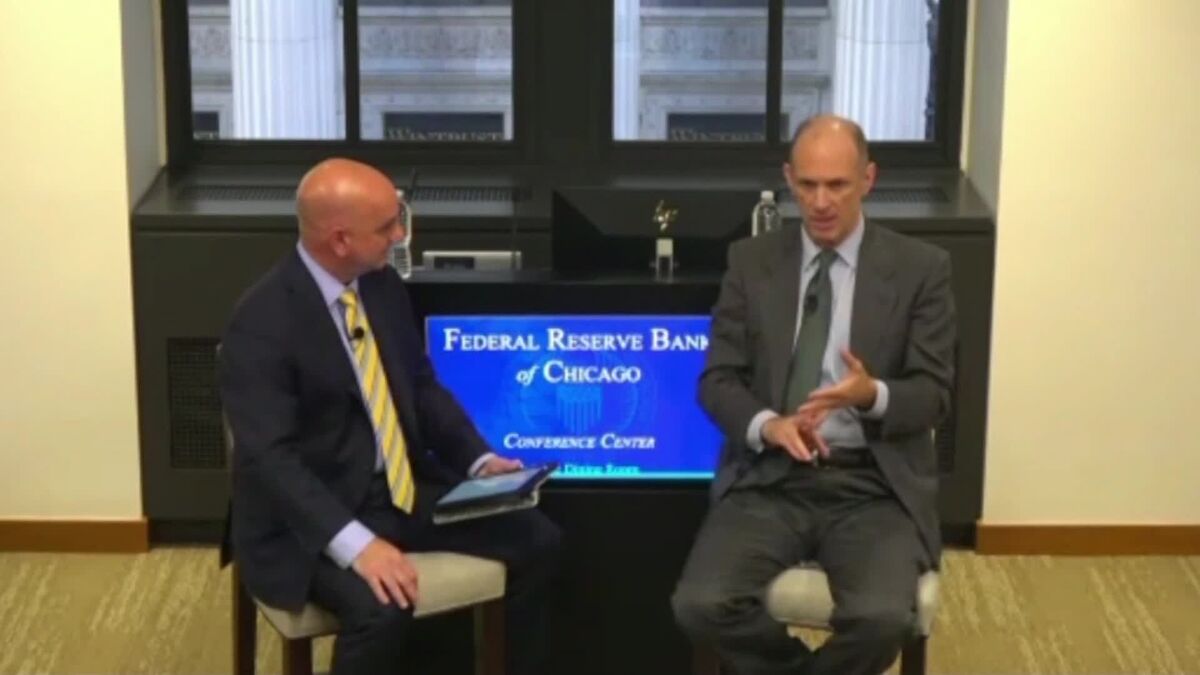

Fed’s Collins notes openness to cutting rates again depending on data

NeutralFinancial Markets

Federal Reserve official Susan Collins has expressed a willingness to consider further interest rate cuts based on upcoming economic data. This statement is significant as it indicates the Fed's ongoing assessment of the economy's performance and its potential impact on monetary policy. Investors and market analysts will be closely watching the data to gauge the likelihood of future rate adjustments, which could influence borrowing costs and economic growth.

— Curated by the World Pulse Now AI Editorial System