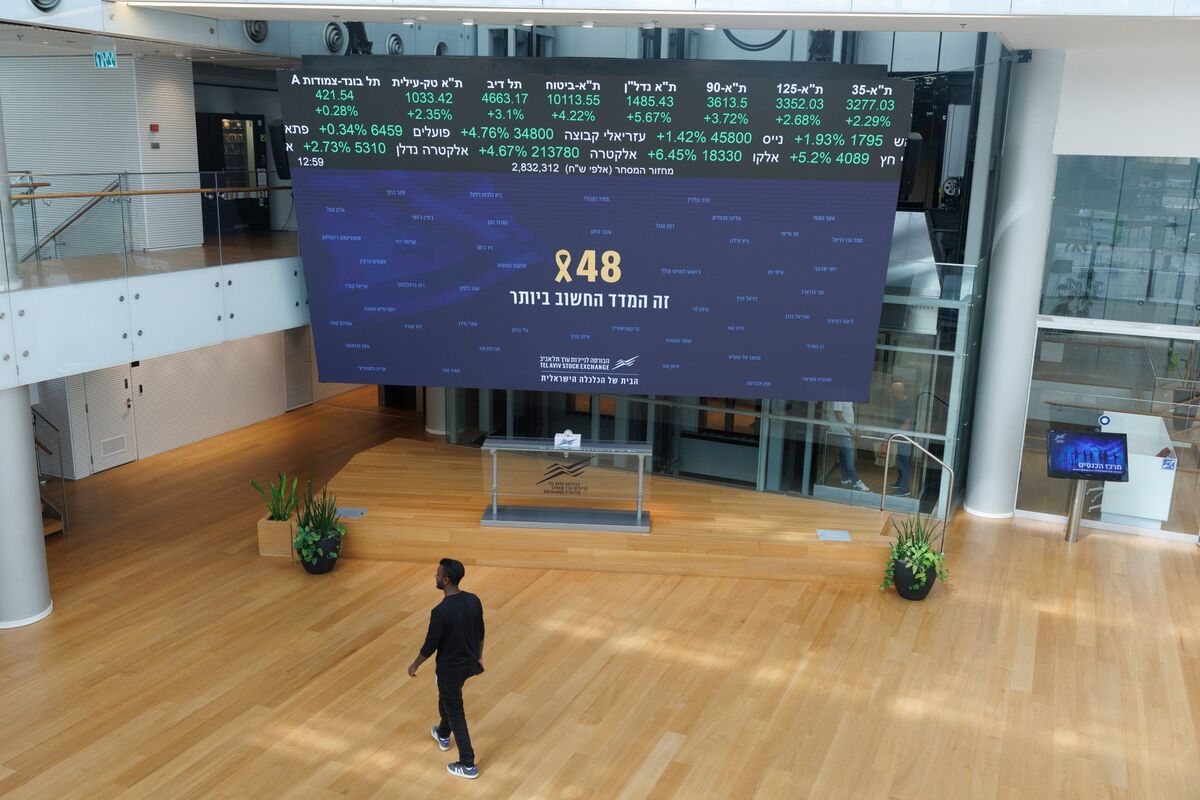

Thousands of Palestinians return by foot to rubble as Gaza ceasefire takes hold

NeutralFinancial Markets

Thousands of Palestinians are returning to their homes in Gaza, which have been reduced to rubble, as a ceasefire takes effect. This development is significant as it marks a moment of relief for many who have been displaced, while U.S. officials are sending around 200 troops to Israel to support and monitor the ceasefire agreement. The situation remains delicate, and the international community is watching closely to see how this ceasefire will impact the region.

— Curated by the World Pulse Now AI Editorial System