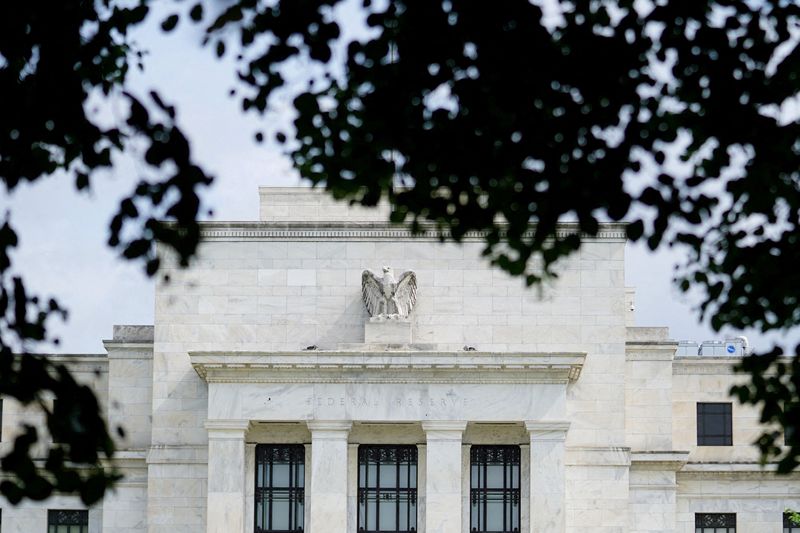

Morning Bid: Fed balm soothes trade war jabs

PositiveFinancial Markets

The latest news highlights how the Federal Reserve's recent actions have provided a calming effect on the ongoing trade war tensions. This is significant because it reassures investors and stabilizes markets, fostering a more optimistic economic outlook. As trade disputes continue to create uncertainty, the Fed's intervention is seen as a crucial step in mitigating risks and encouraging growth.

— Curated by the World Pulse Now AI Editorial System