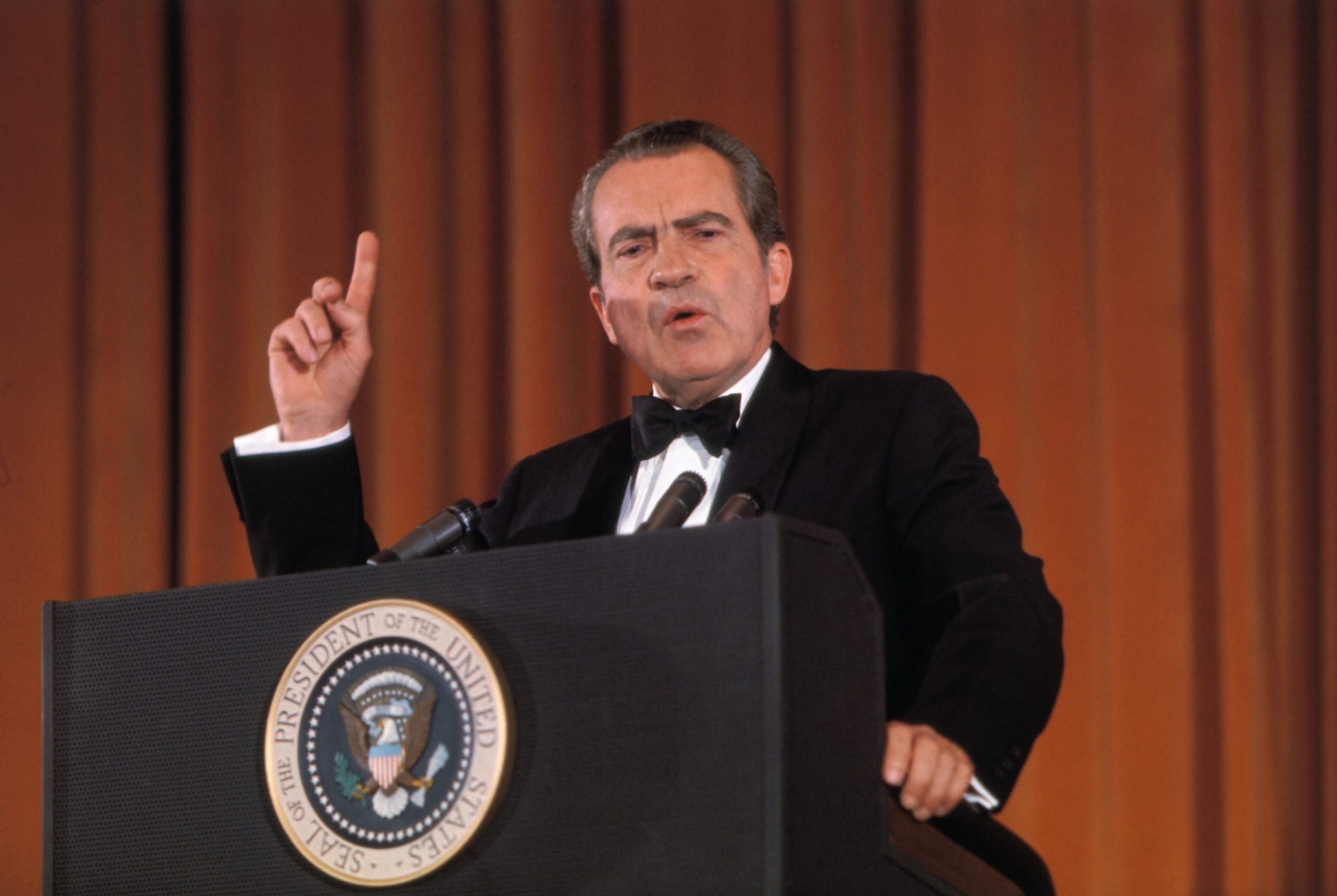

Goldman Sachs says the demand for gold is not just hype, and predicts the U.S. could still see a repeat of a Nixon-era spike

PositiveFinancial Markets

Goldman Sachs has highlighted that the current demand for gold is not merely a passing trend, suggesting that the U.S. might experience a surge in gold prices reminiscent of the dramatic increases seen during the Nixon era. Between 1970 and 1980, gold prices soared over 2,300% due to factors like the end of the gold standard, rampant inflation, and the oil crisis. This insight is significant as it indicates potential economic shifts and investment opportunities, making gold a focal point for investors looking to hedge against inflation.

— Curated by the World Pulse Now AI Editorial System