Smarter Web Company adds 10 bitcoin to its treasury holdings

PositiveFinancial Markets

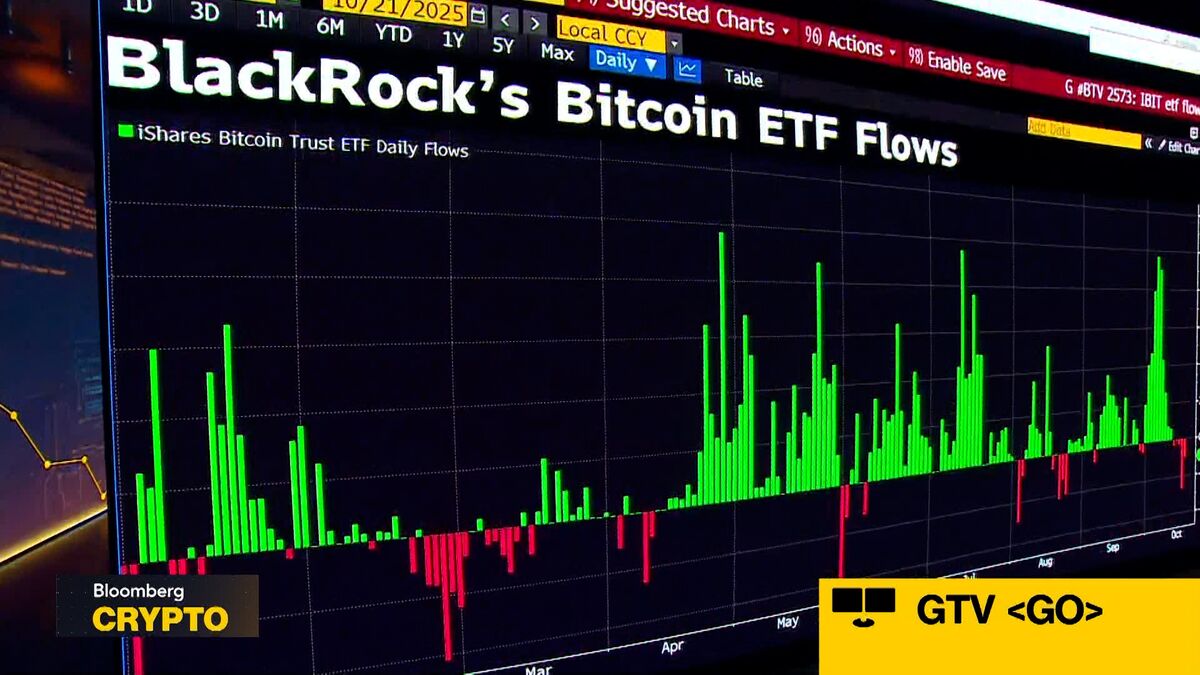

Smarter Web Company has made a significant move by adding 10 bitcoin to its treasury holdings, reflecting a growing trend among companies to invest in cryptocurrency. This decision not only strengthens their financial position but also signals confidence in the future of digital currencies. As more businesses embrace bitcoin, it could pave the way for broader acceptance and integration of cryptocurrencies in the mainstream economy.

— Curated by the World Pulse Now AI Editorial System