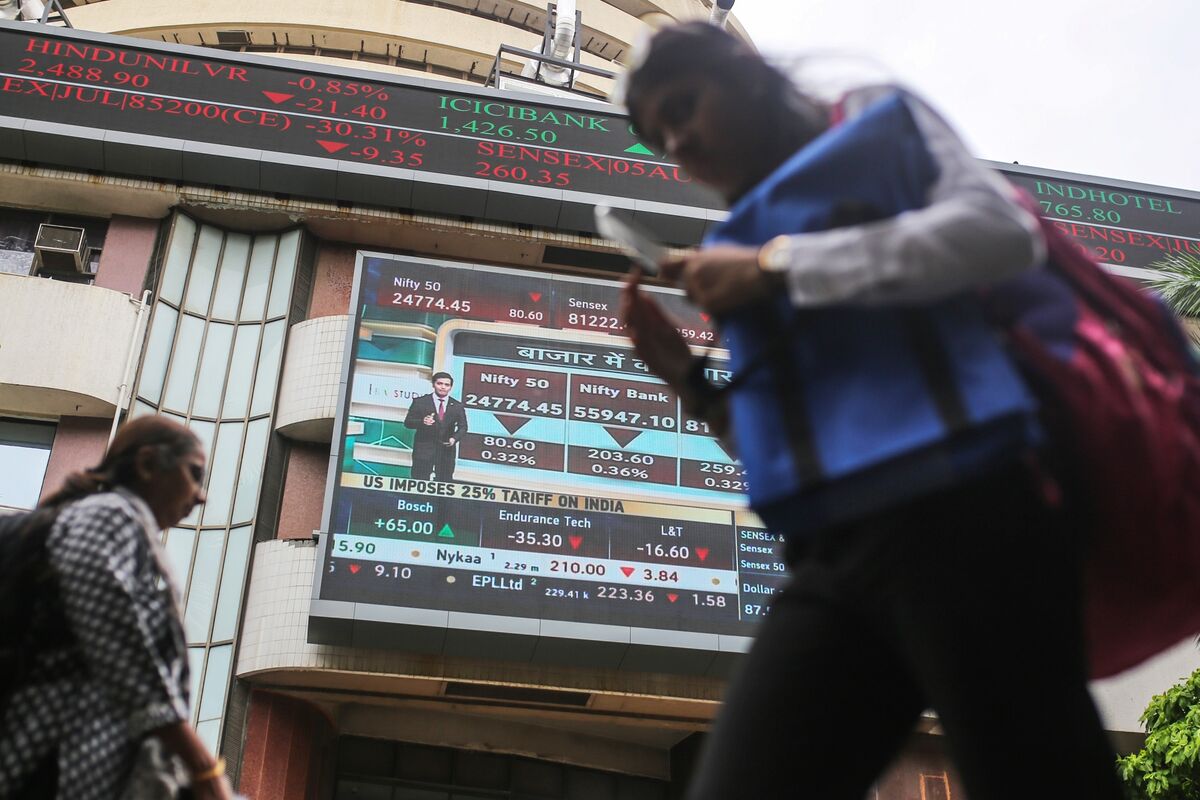

Ford to make new engines in India with $370 million investment, Bloomberg News reports

PositiveFinancial Markets

Ford is set to invest $370 million in India to manufacture new engines, marking a significant step in the company's expansion in the region. This investment not only highlights Ford's commitment to the Indian market but also promises to create jobs and boost the local economy. As global automakers increasingly look to India for growth, this move positions Ford favorably in a competitive landscape.

— Curated by the World Pulse Now AI Editorial System