Top analyst calls 'kick in the pants' for S&P 500

PositiveFinancial Markets

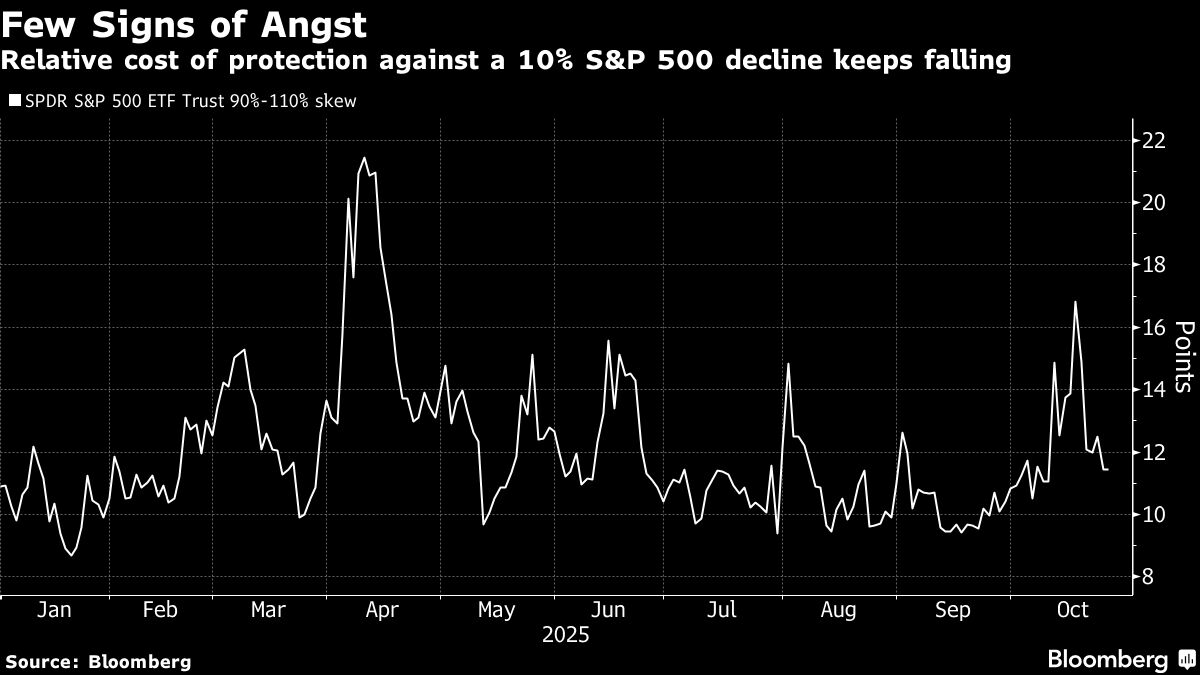

The S&P 500 index is showing strong performance, closing near 6,792 and up for the week, as it approaches record highs. With a remarkable three-month gain of 8% and a consistent six-month upward trend, this surge is largely attributed to the recent September CPI report. This positive momentum is significant as it reflects investor confidence and could indicate a robust economic outlook.

— Curated by the World Pulse Now AI Editorial System