Japan to Sell Benchmark Bonds as Looming LDP Vote Clouds Outlook

NeutralFinancial Markets

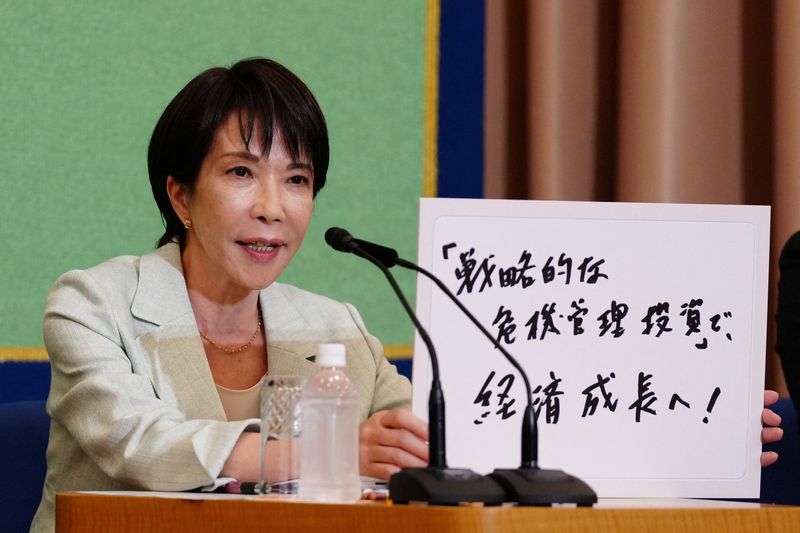

Japan is set to sell benchmark 10-year bonds on Thursday, coinciding with a crucial vote within the ruling Liberal Democratic Party (LDP) to elect a new leader. This election is significant as it will shape the country's fiscal and economic policies moving forward. Investors will be closely watching the outcome, as it could influence market stability and Japan's financial direction.

— Curated by the World Pulse Now AI Editorial System