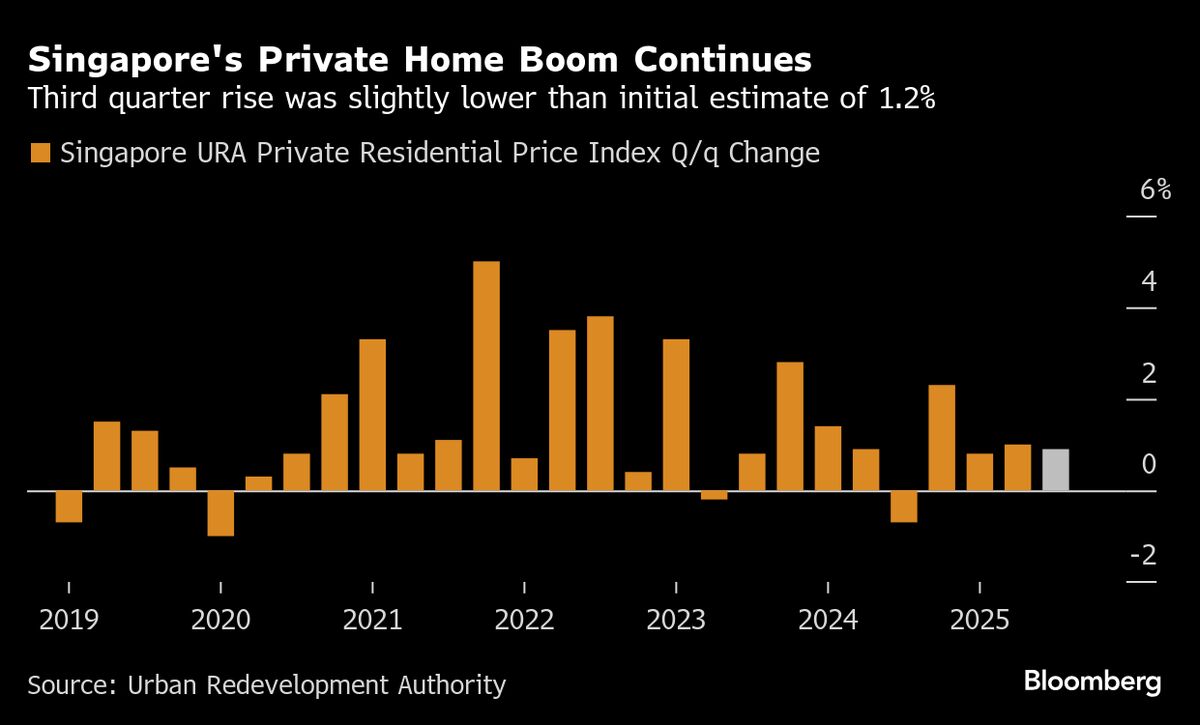

Singapore Home Prices Rise for Fourth Quarter, Rents Increase

PositiveFinancial Markets

Singapore's private home prices have seen a notable increase for the fourth consecutive quarter, indicating a robust demand for new units. This trend is significant as it suggests a sustained boom in the real estate market, which could have positive implications for the economy and potential investors.

— Curated by the World Pulse Now AI Editorial System