America's top banker sounds warning on US stock market fall

NegativeFinancial Markets

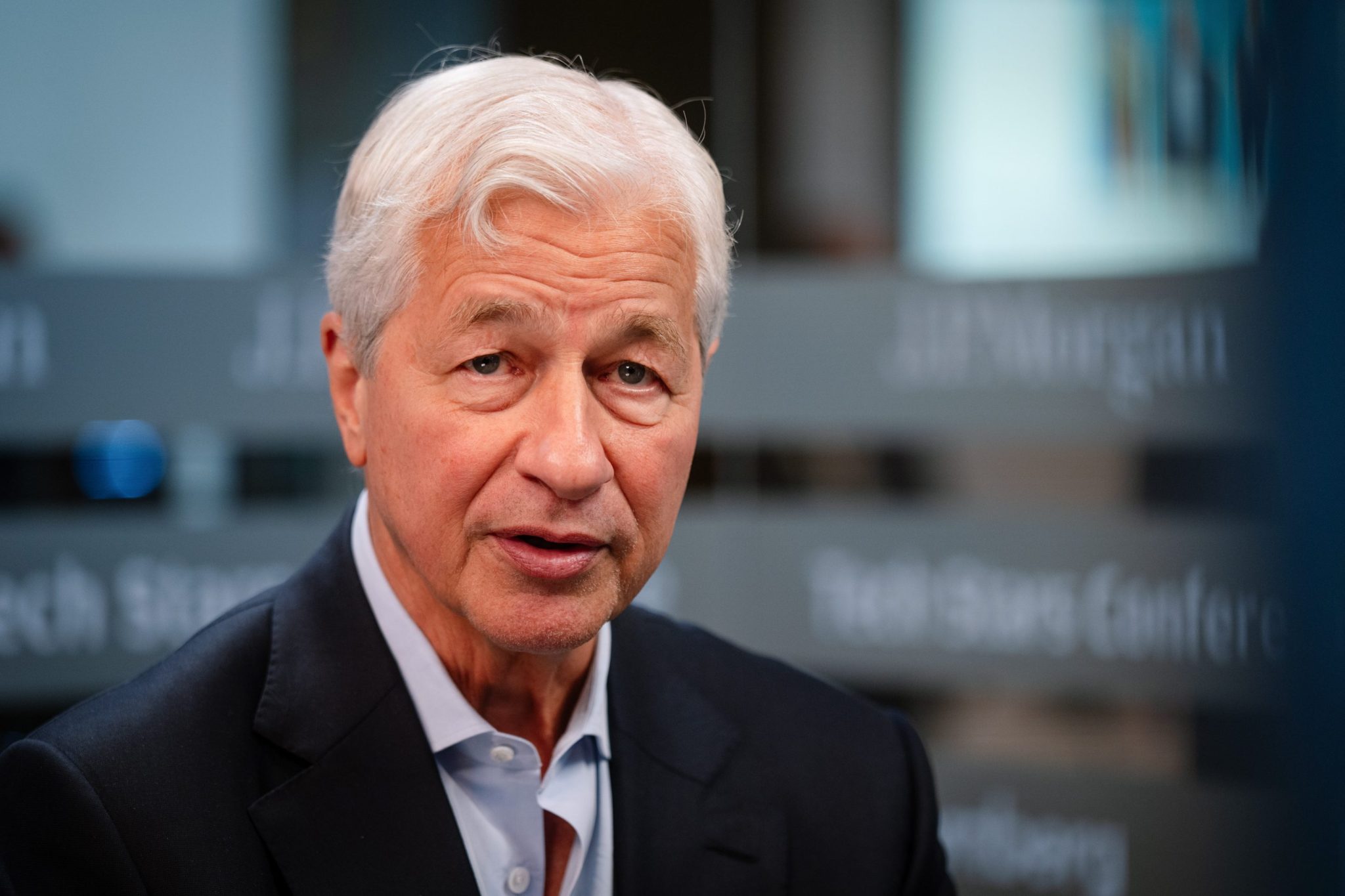

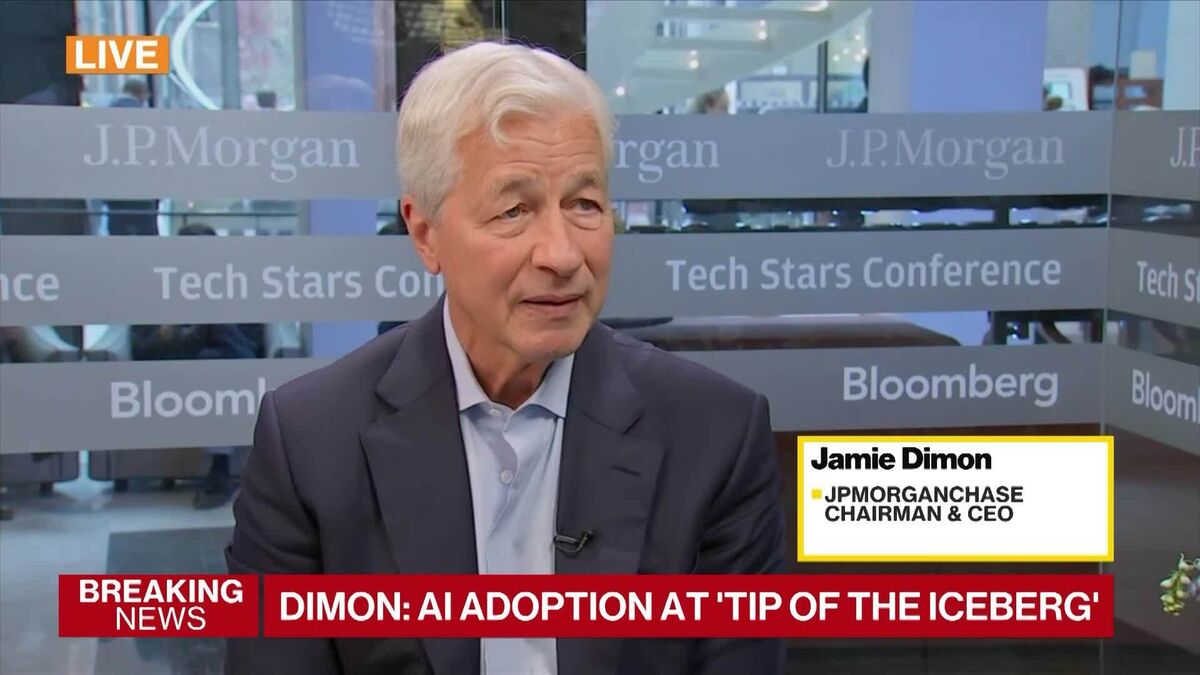

Jamie Dimon, America's top banker, has expressed significant concern about a potential downturn in the US stock market, stating he is 'far more worried than others.' This warning highlights the growing anxiety among financial leaders regarding market stability, which could impact investors and the economy at large.

— Curated by the World Pulse Now AI Editorial System