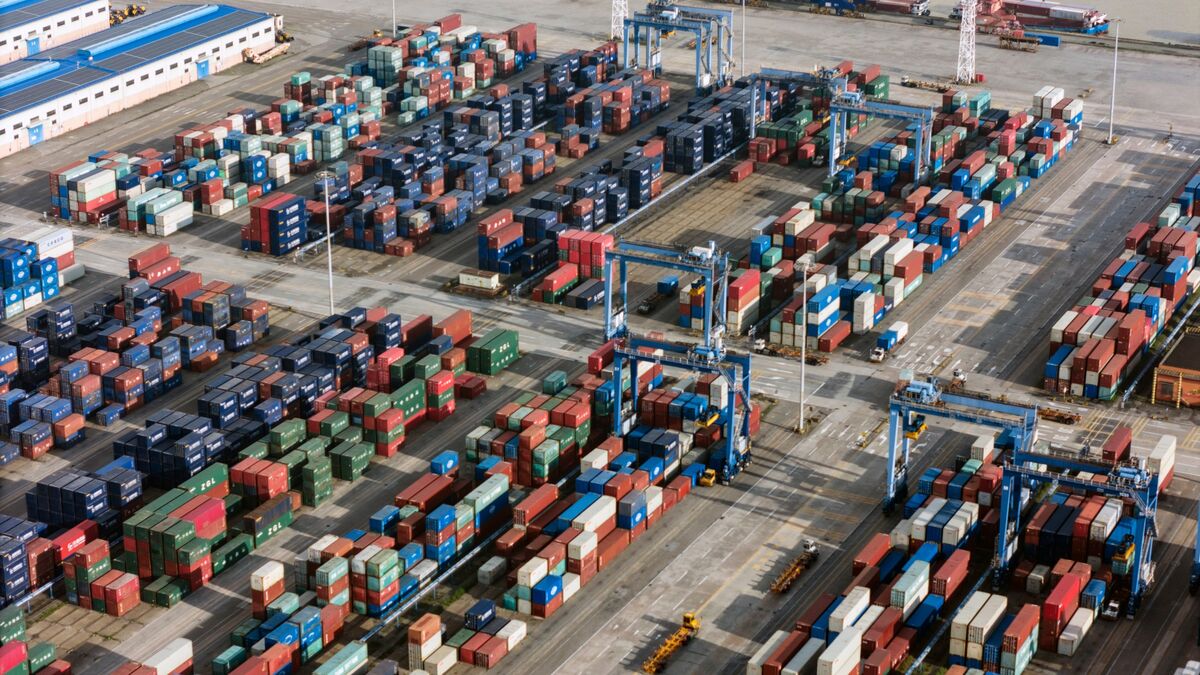

Pimco CEO Roman Says Tariff Uncertainty Poses Risks to US Stocks

NegativeFinancial Markets

Emmanuel Roman, CEO of Pimco, has raised concerns about the uncertainty surrounding US President Donald Trump's tariff policies and their potential impact on the stock market. As these tariffs evolve, they could significantly influence investor confidence and market performance, making it crucial for stakeholders to stay informed about these developments.

— Curated by the World Pulse Now AI Editorial System