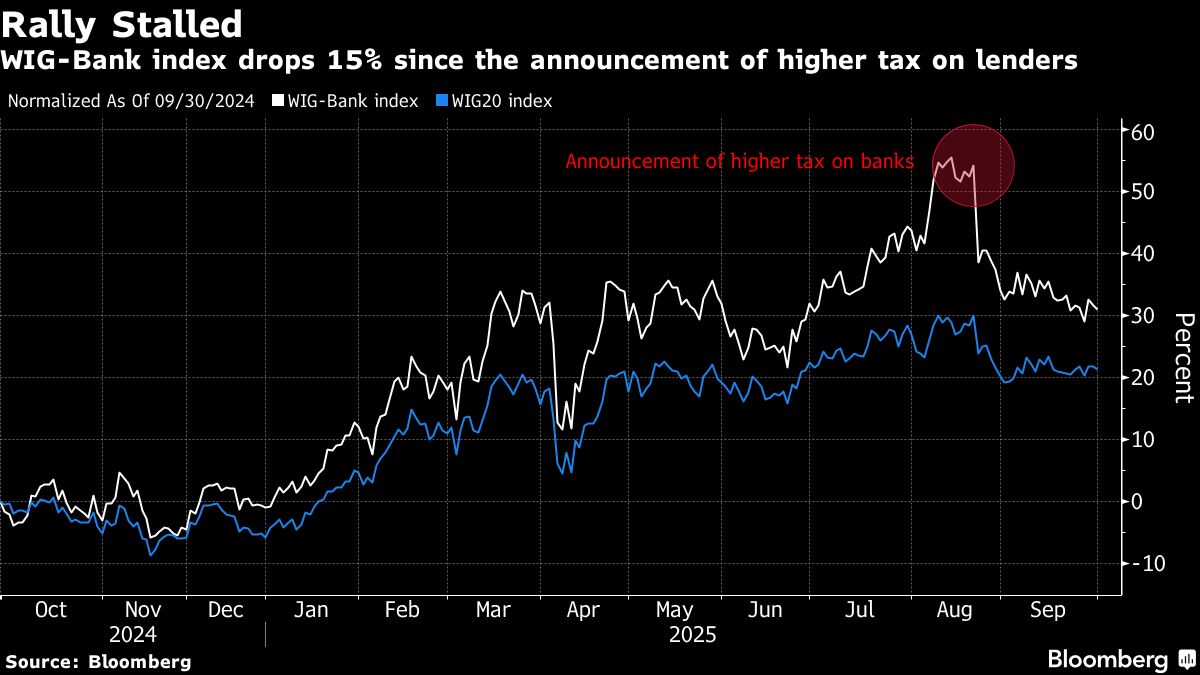

Poland Pushes Ahead With Bank-Tax Increase to Help Ailing Budget

PositiveFinancial Markets

Poland's government is moving forward with a plan to increase corporate income taxes on banks to strengthen its budget. This decision comes despite worries about how the tax might affect credit availability and banking costs. By taking this step, Poland aims to address its financial challenges while ensuring that the banking sector remains robust, which is crucial for the country's economic stability.

— Curated by the World Pulse Now AI Editorial System