Bank of America hiring data sounds alarm on economy

NeutralFinancial Markets

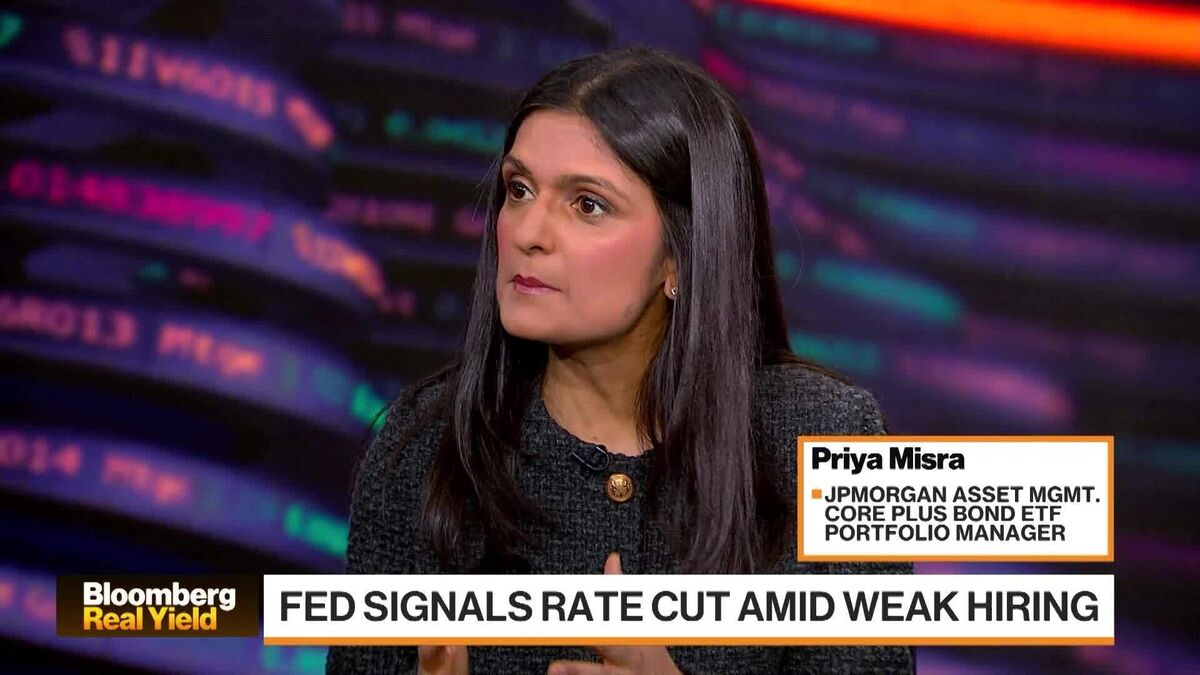

The recent hiring data from Bank of America has raised concerns about the state of the economy, particularly in relation to the Federal Reserve's interest rate decisions. As the Fed closely monitors the jobs market, the potential for further interest rate cuts depends significantly on employment trends. This situation is crucial as it affects borrowing costs and overall economic growth, making it a key focus for both policymakers and the public.

— Curated by the World Pulse Now AI Editorial System