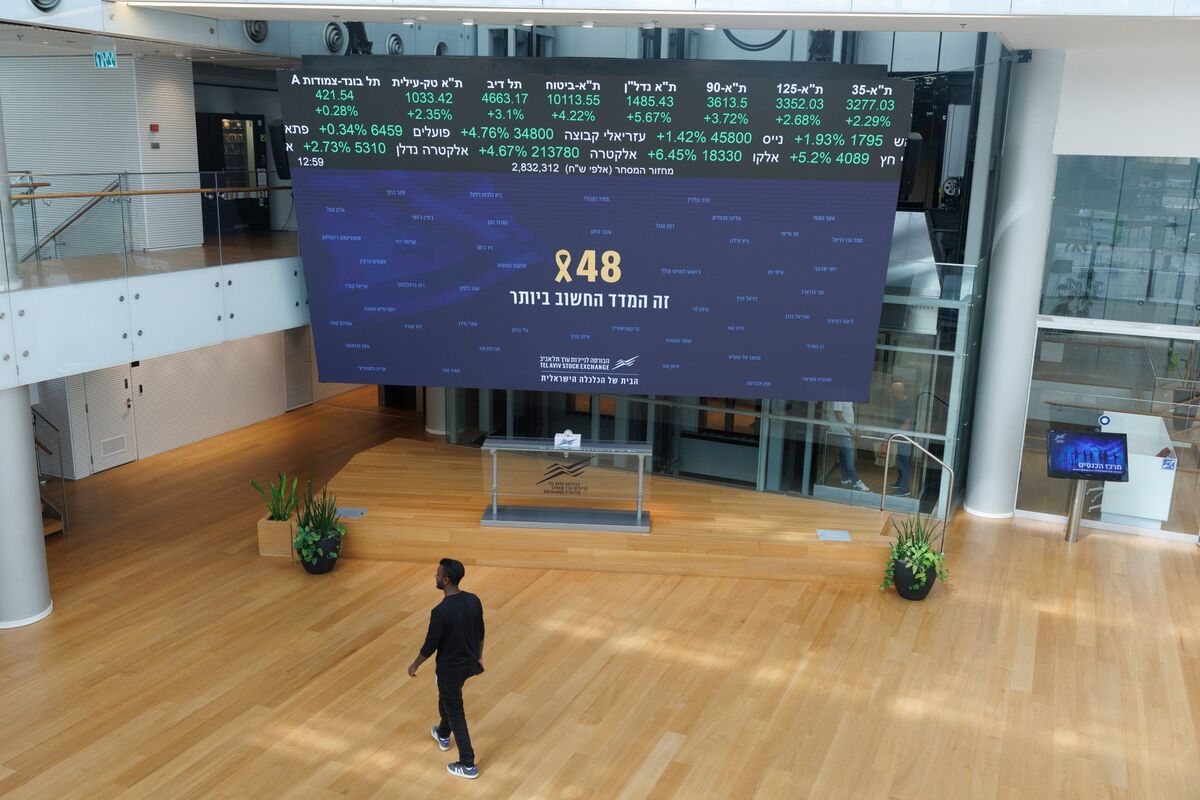

Egypt Gets S&P Upgrade in Latest Sign of Economic Turnaround

PositiveFinancial Markets

Egypt has received a credit rating upgrade from S&P Ratings, a clear indication of the country's improving economic situation. This upgrade comes on the heels of significant policy changes and follows a substantial $57 billion global bailout, which has provided much-needed support to the nation's economy. This positive development not only reflects the effectiveness of the government's reforms but also boosts investor confidence, paving the way for future growth and stability.

— Curated by the World Pulse Now AI Editorial System