Microsoft deal allows OpenAI to raise capital more easily, says CFO

PositiveFinancial Markets

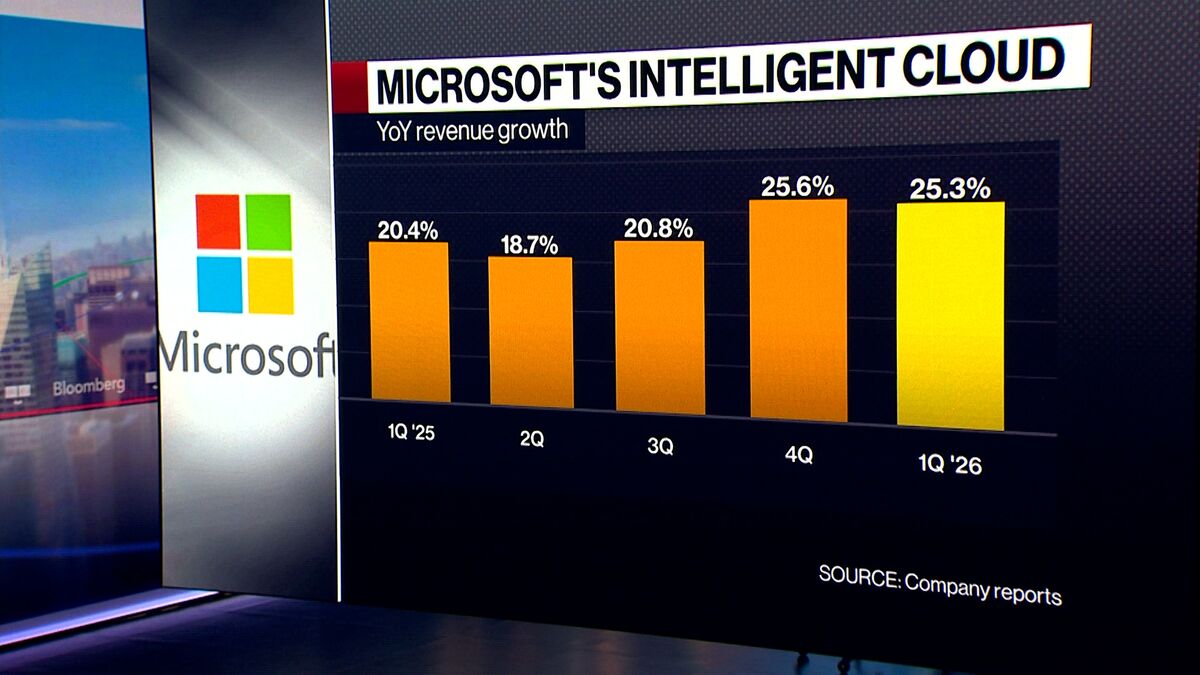

Microsoft's recent deal with OpenAI is a game changer, as it enables OpenAI to raise capital more easily, according to their CFO. This partnership not only strengthens their financial position but also highlights the growing confidence in AI technologies. As OpenAI continues to innovate, this financial backing could accelerate their projects and impact the tech landscape significantly.

— Curated by the World Pulse Now AI Editorial System