Fed Signals Rate Cut, Credit Concerns Rattle Wall Street | Real Yield 10/17/2025

NeutralFinancial Markets

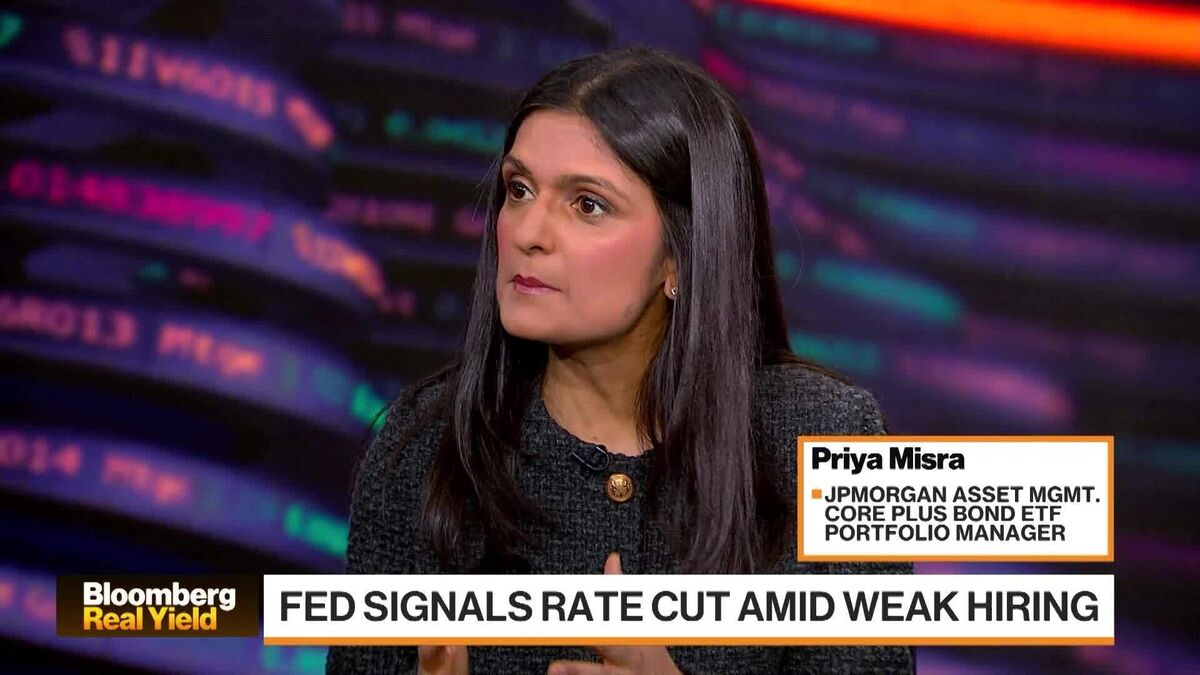

In a recent episode of Bloomberg Real Yield, experts discussed the Federal Reserve's signals regarding potential rate cuts and the resulting concerns affecting Wall Street. With insights from key figures like Steve Brown from Guggenheim and Meghan Graper from Barclays, the conversation highlighted the implications of these financial shifts. Understanding these developments is crucial for investors as they navigate a changing economic landscape.

— Curated by the World Pulse Now AI Editorial System