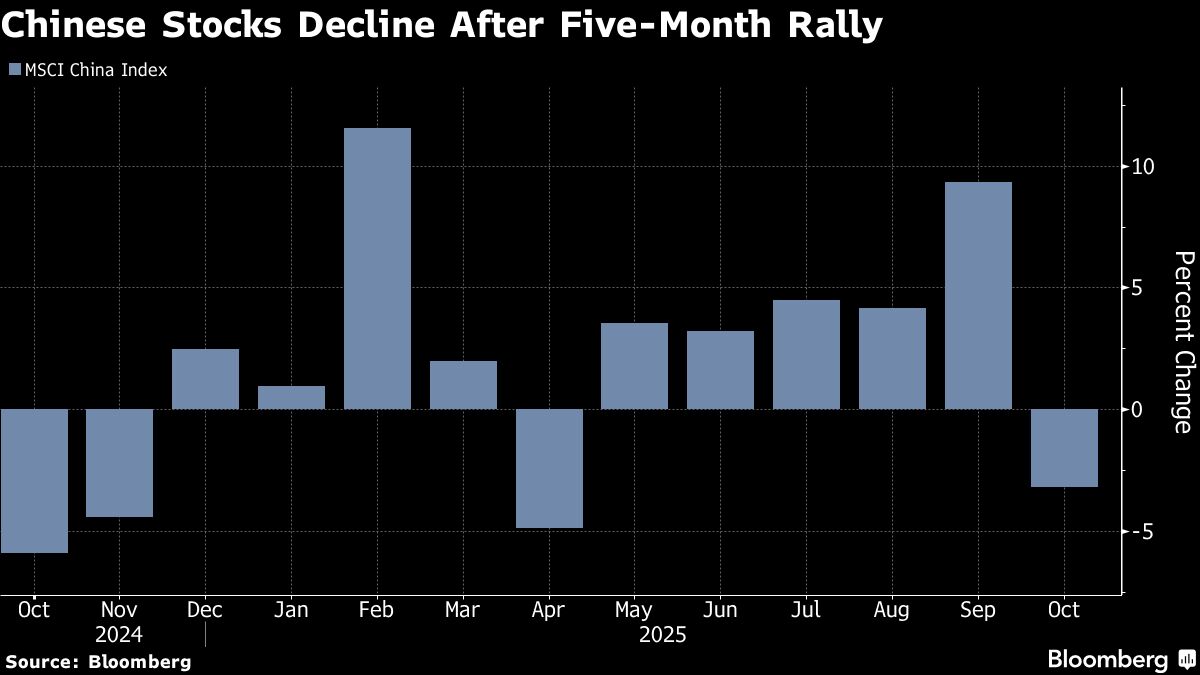

Goldman Sachs Sees 30% Upside for Chinese Stocks Through 2027

PositiveFinancial Markets

Goldman Sachs is optimistic about the future of Chinese stocks, predicting a 30% increase by the end of 2027. This forecast is backed by supportive pro-market policies, increasing corporate profits, and strong capital inflows. Such growth could signal a robust recovery for investors and the broader economy, making it an important development for those interested in the Asian markets.

— Curated by the World Pulse Now AI Editorial System