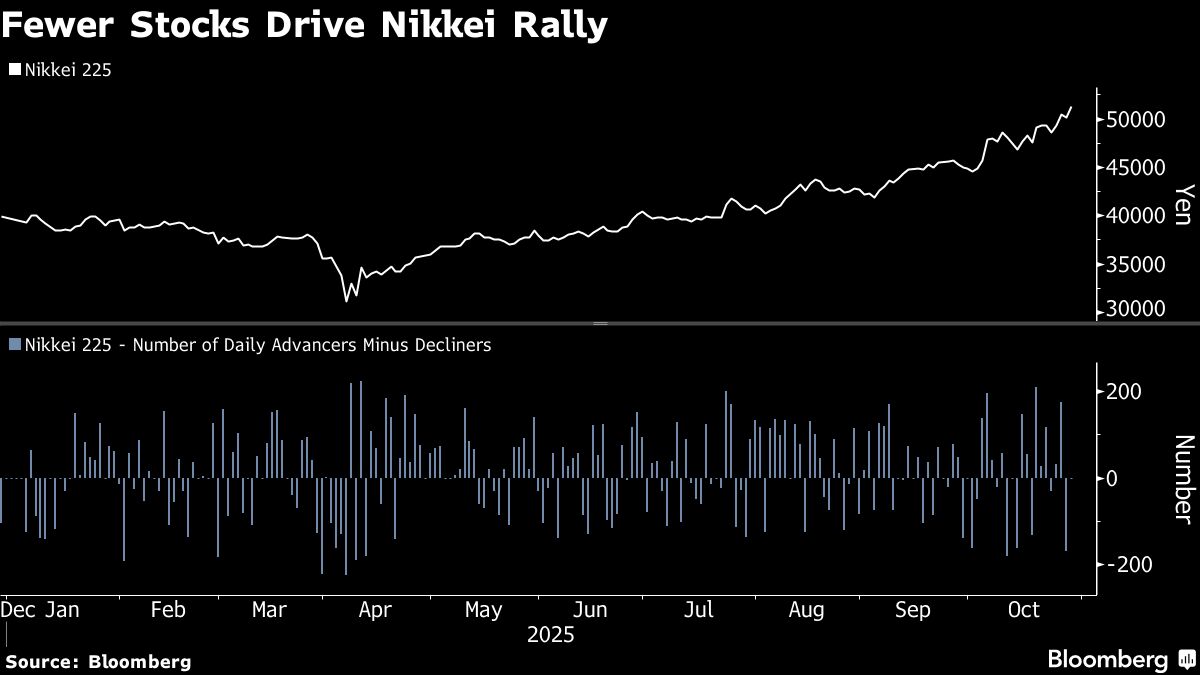

Nikkei’s Rally Seen Vulnerable With Few Stocks Driving Gains

NeutralFinancial Markets

Japan's Nikkei index surged by 2.2% to reach a new record, but the rally is largely driven by a small number of stocks. This narrow participation raises concerns about the sustainability of the gains, suggesting that the market could be at risk of a correction. Investors should be cautious as the reliance on a few key players may indicate underlying vulnerabilities.

— Curated by the World Pulse Now AI Editorial System