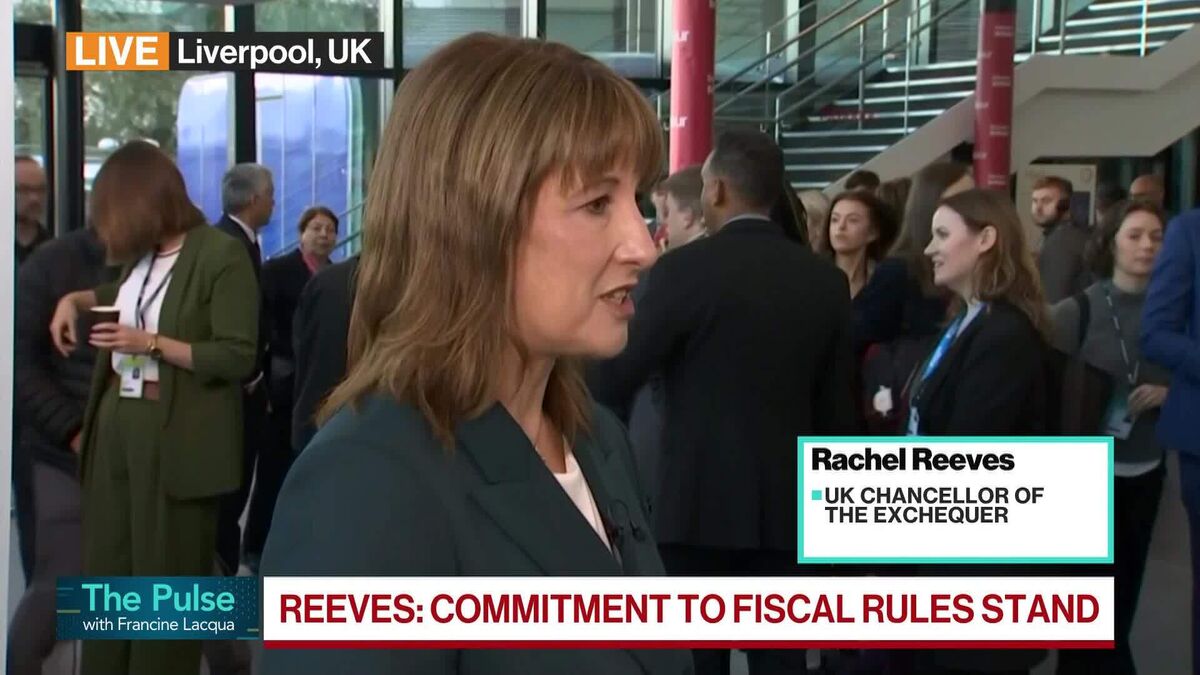

In Full: UK's Reeves on Fiscal Discipline, Tax Policies, Starmer

PositiveFinancial Markets

UK Chancellor Rachel Reeves recently emphasized her dedication to fiscal discipline and tackling child poverty during an interview at the Labour Party's annual conference in Liverpool. Her insights on tax policies and Prime Minister Keir Starmer's leadership highlight a proactive approach to addressing economic challenges, which is crucial for the UK's future. This commitment not only aims to improve the lives of families but also reflects a broader strategy to strengthen the economy.

— Curated by the World Pulse Now AI Editorial System