Dave Ramsey, AARP raise red flag on Medicare; changes coming soon

NeutralFinancial Markets

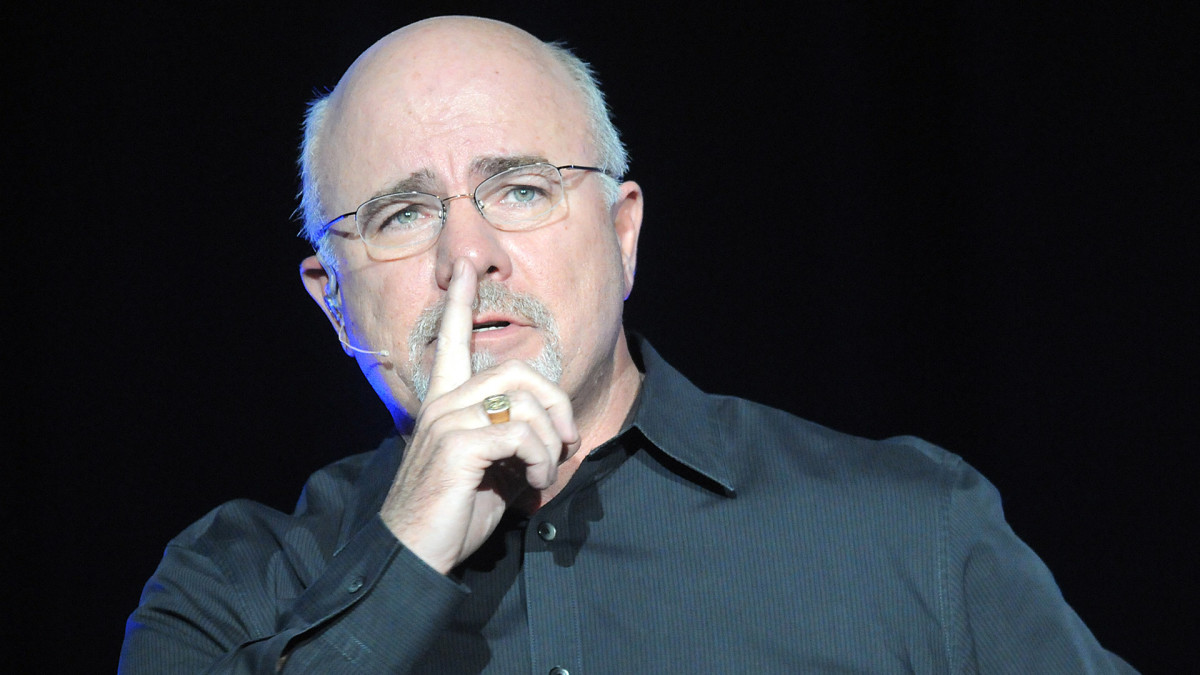

The Annual Enrollment Period for Medicare is approaching, running from October 15 to December 7, and it's a crucial time for beneficiaries to reassess their coverage options. Financial expert Dave Ramsey and the AARP are highlighting the importance of this period, urging individuals to carefully review their plans and consider potential changes. This matters because making informed decisions during this time can significantly impact healthcare costs and access for seniors.

— Curated by the World Pulse Now AI Editorial System