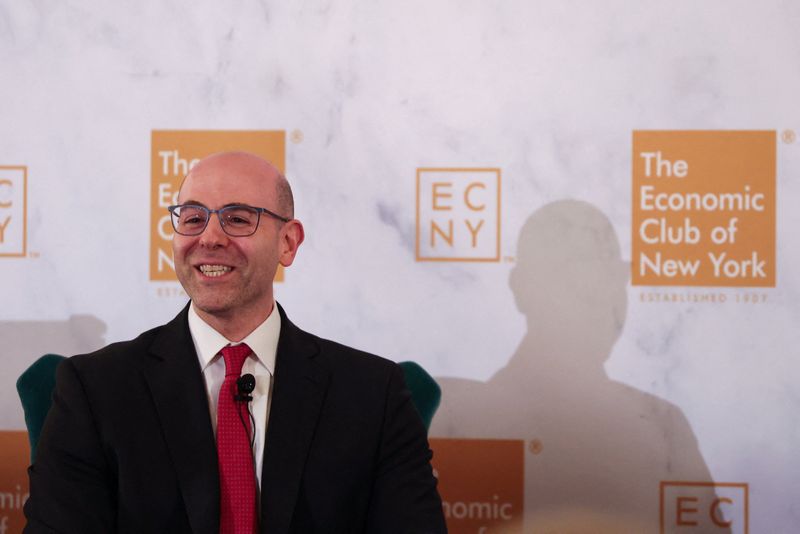

Consumers See Higher Inflation in Year Ahead, NY Fed Survey Shows

NegativeFinancial Markets

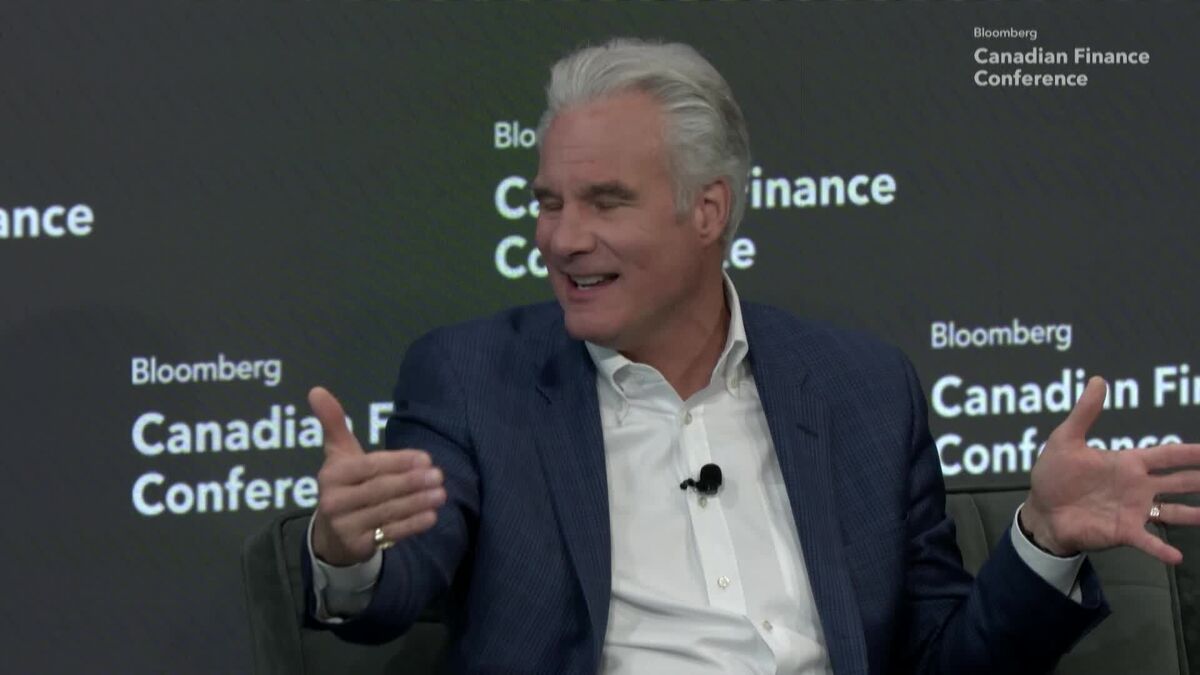

A recent survey from the Federal Reserve Bank of New York reveals that consumers expect higher inflation in the coming year, particularly affecting lower and middle-income households. This trend is concerning as it indicates that these households are bearing the brunt of rising prices, which could impact their purchasing power and overall economic stability.

— Curated by the World Pulse Now AI Editorial System