Canada stocks lower at close of trade; S&P/TSX Composite down 1.38%

NegativeFinancial Markets

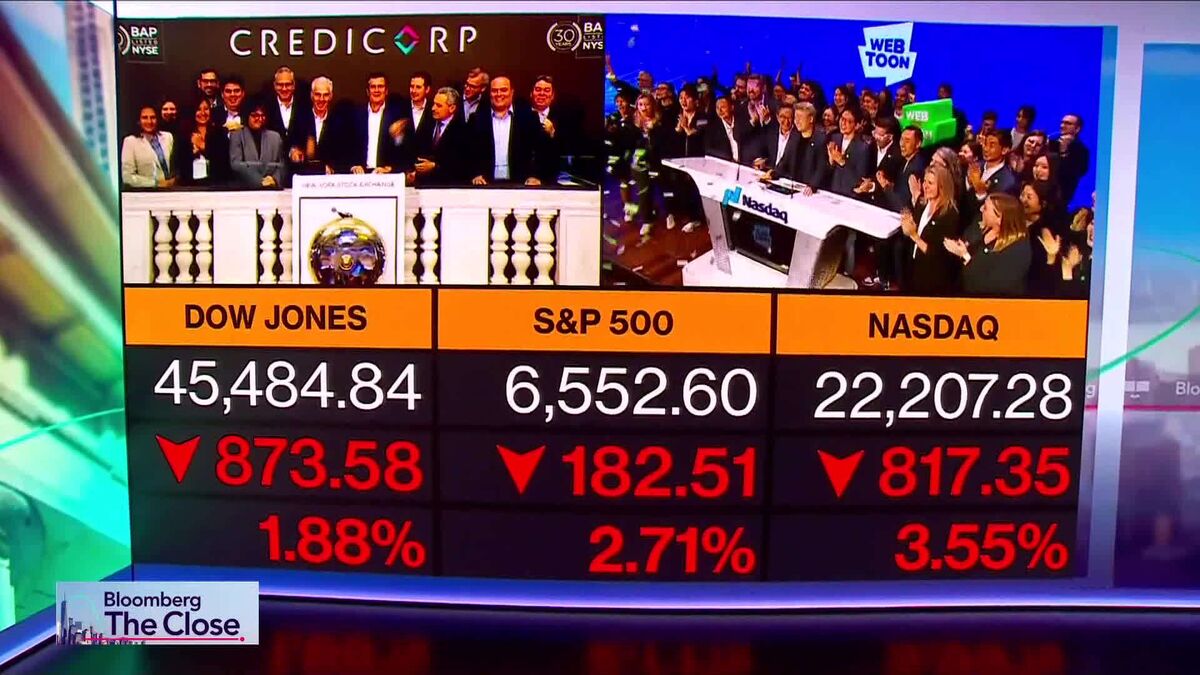

Canada's stock market closed lower, with the S&P/TSX Composite index dropping by 1.38%. This decline reflects broader market trends and investor concerns, which could impact economic confidence and investment strategies moving forward.

— Curated by the World Pulse Now AI Editorial System