Jefferies Names 2 Cable Stocks to Buy, Turns Cautious on 1

PositiveFinancial Markets

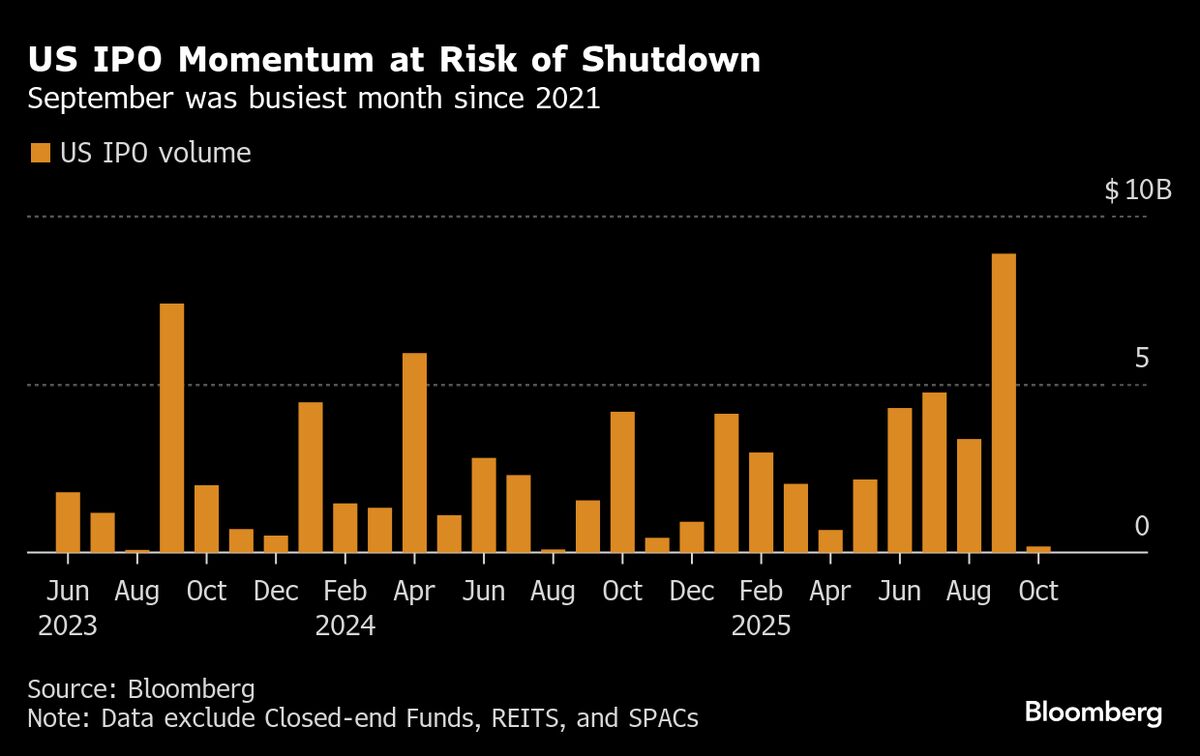

Jefferies has identified two cable stocks as strong buy opportunities, signaling confidence in their potential for growth. This recommendation comes at a time when investors are looking for reliable options in a fluctuating market. However, Jefferies has also expressed caution regarding one particular stock, suggesting a more nuanced approach to investment in the cable sector. This insight is crucial for investors aiming to navigate the complexities of the current market landscape.

— Curated by the World Pulse Now AI Editorial System