Lots More on the Fed’s Target and the Price of Money (Podcast)

NeutralFinancial Markets

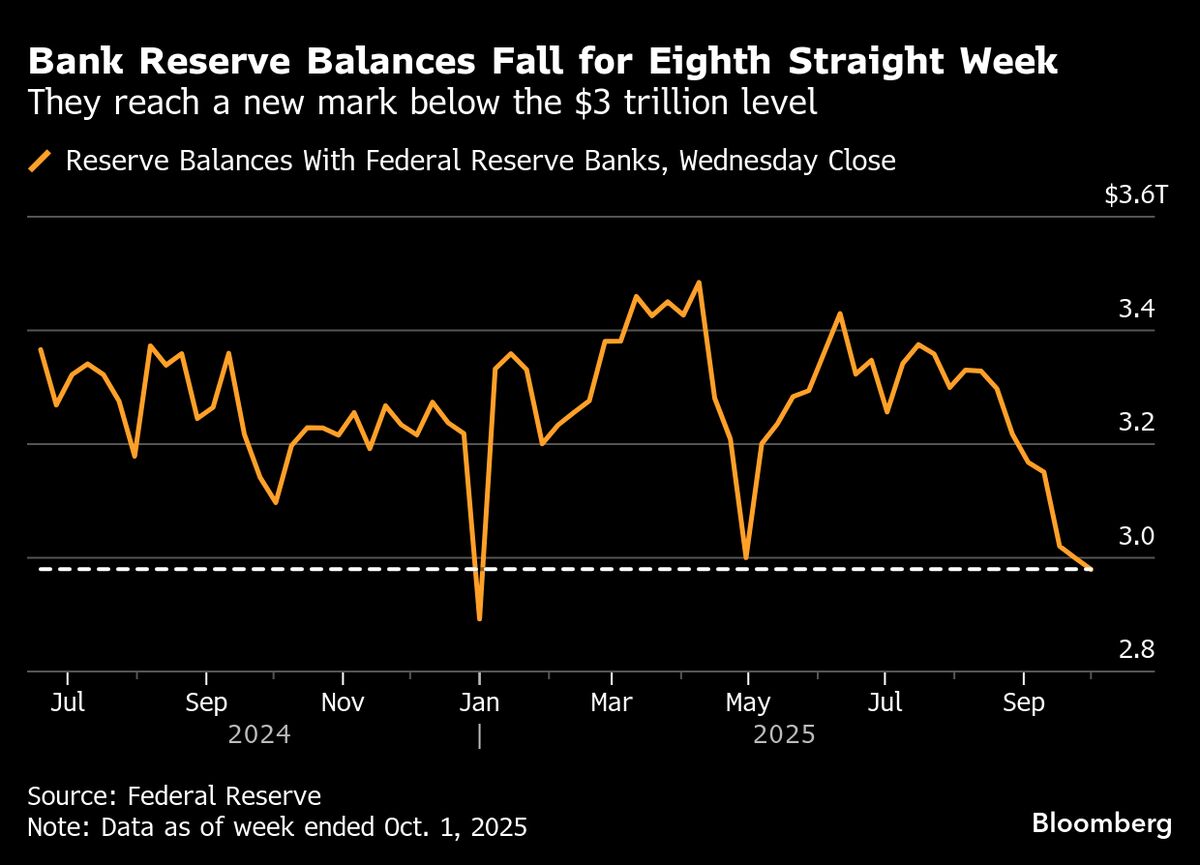

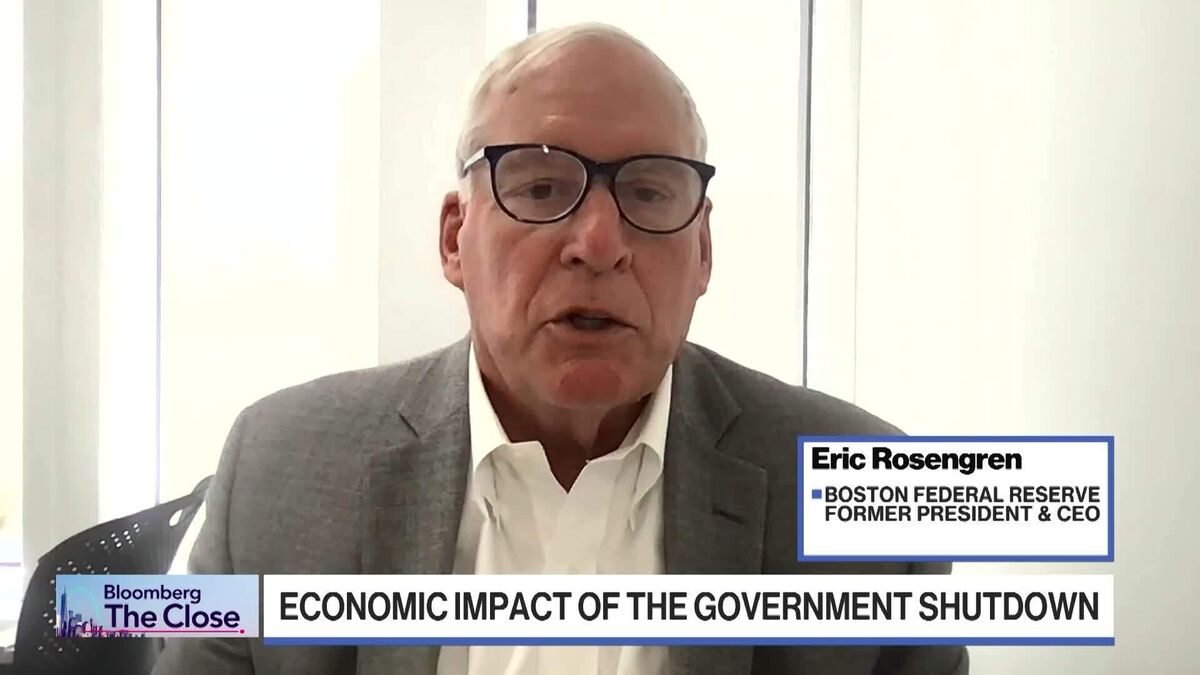

In a recent podcast, Dallas Fed President Lorie Logan discussed the complexities of the Federal Reserve's approach to interest rates, suggesting that the current fed funds target may be outdated. This conversation is significant as it highlights potential shifts in monetary policy that could impact how banks manage their reserves and influence the broader economy.

— Curated by the World Pulse Now AI Editorial System