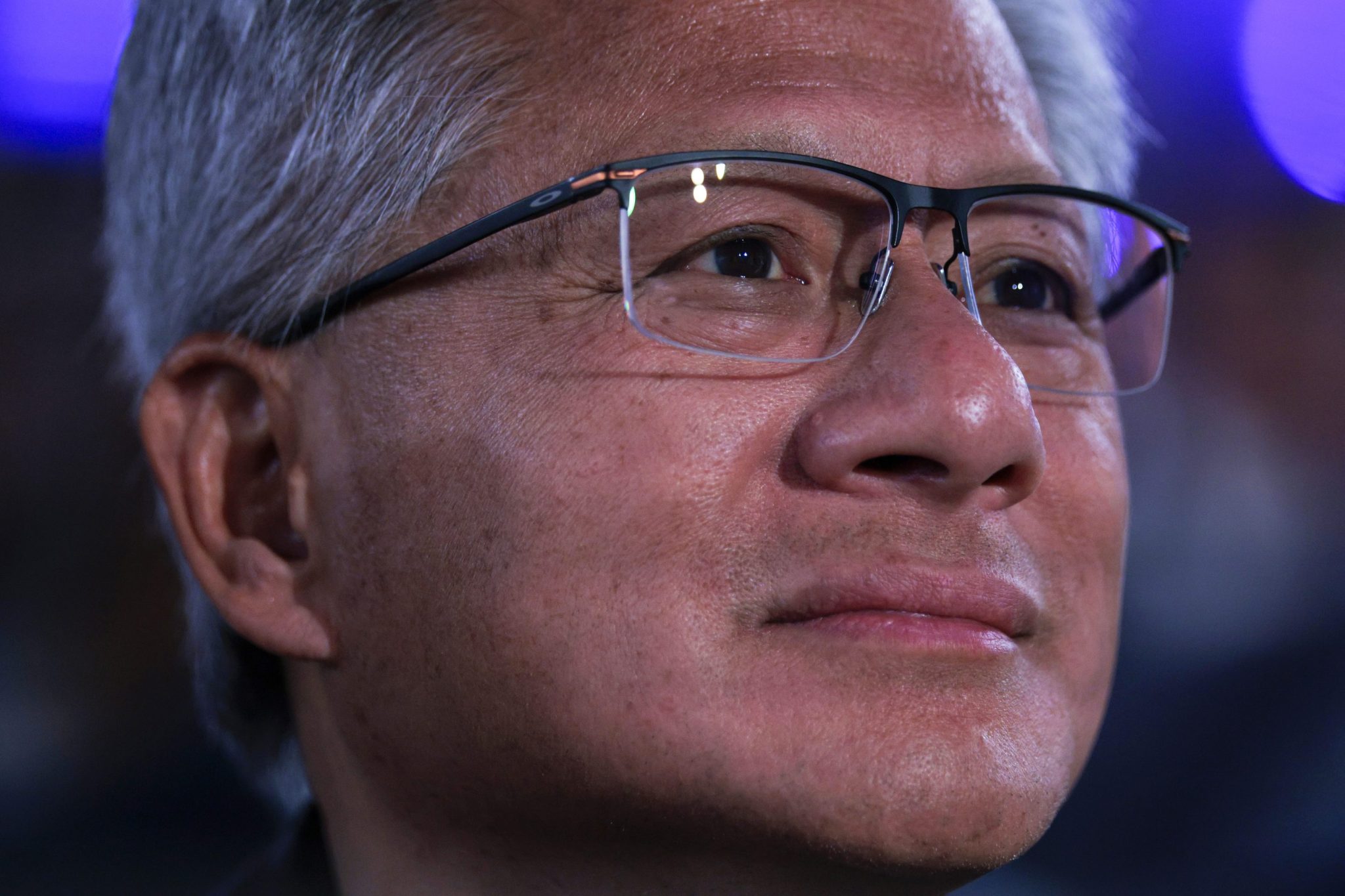

How Nvidia’s Jensen Huang became AI’s global salesman

PositiveFinancial Markets

Nvidia's CEO Jensen Huang is making waves in the tech world by advocating for countries to develop their own 'sovereign' AI ecosystems, emphasizing the importance of local innovation while still relying on Nvidia's cutting-edge technology. This approach not only highlights the growing significance of AI in global markets but also positions Nvidia as a key player in shaping the future of artificial intelligence. Huang's vision could lead to a more decentralized and diverse AI landscape, which is crucial for fostering innovation and competition.

— Curated by the World Pulse Now AI Editorial System