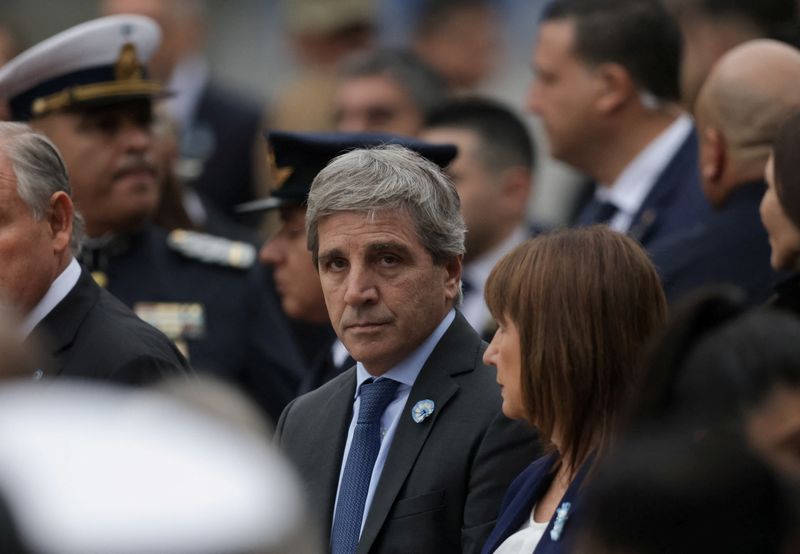

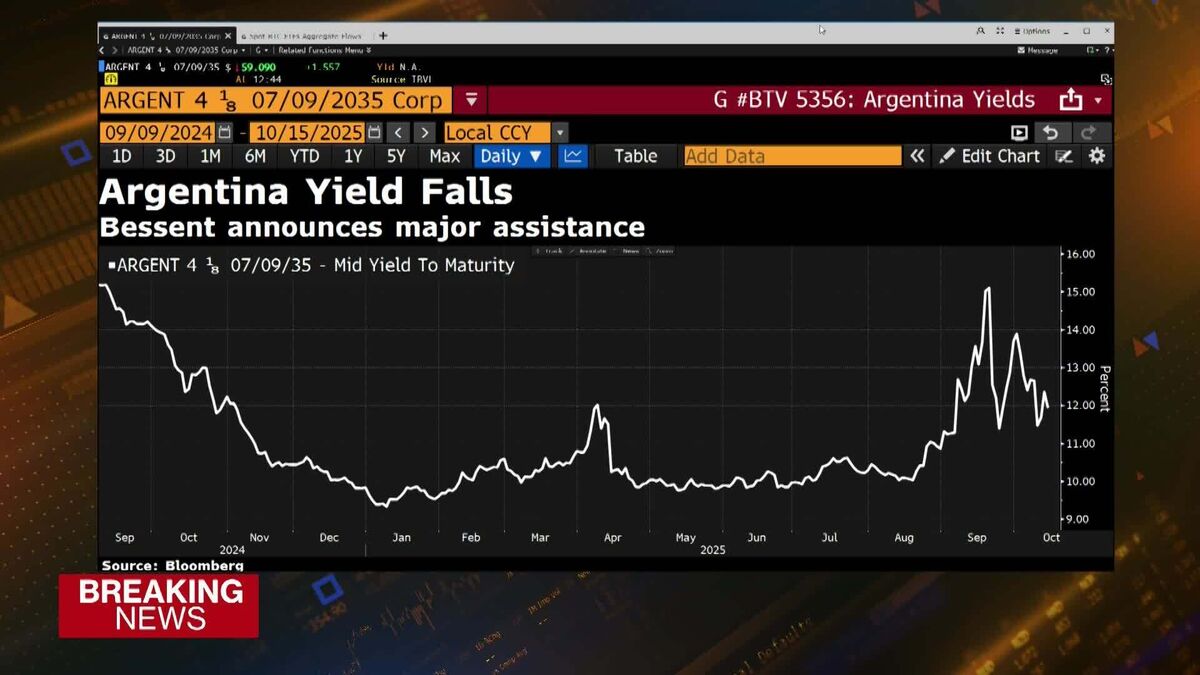

Argentina Says US Treasury Will Continue to Support Peso

PositiveFinancial Markets

Argentina's Economy Minister Luis Caputo has announced that the US Treasury will continue to support the Argentine peso with a $20 billion currency-swap line, regardless of the upcoming midterm elections. This commitment is crucial for Argentina as it seeks to stabilize its economy and strengthen its currency amidst ongoing financial challenges. The assurance from the US is a positive sign for investors and could help bolster confidence in Argentina's economic recovery.

— Curated by the World Pulse Now AI Editorial System