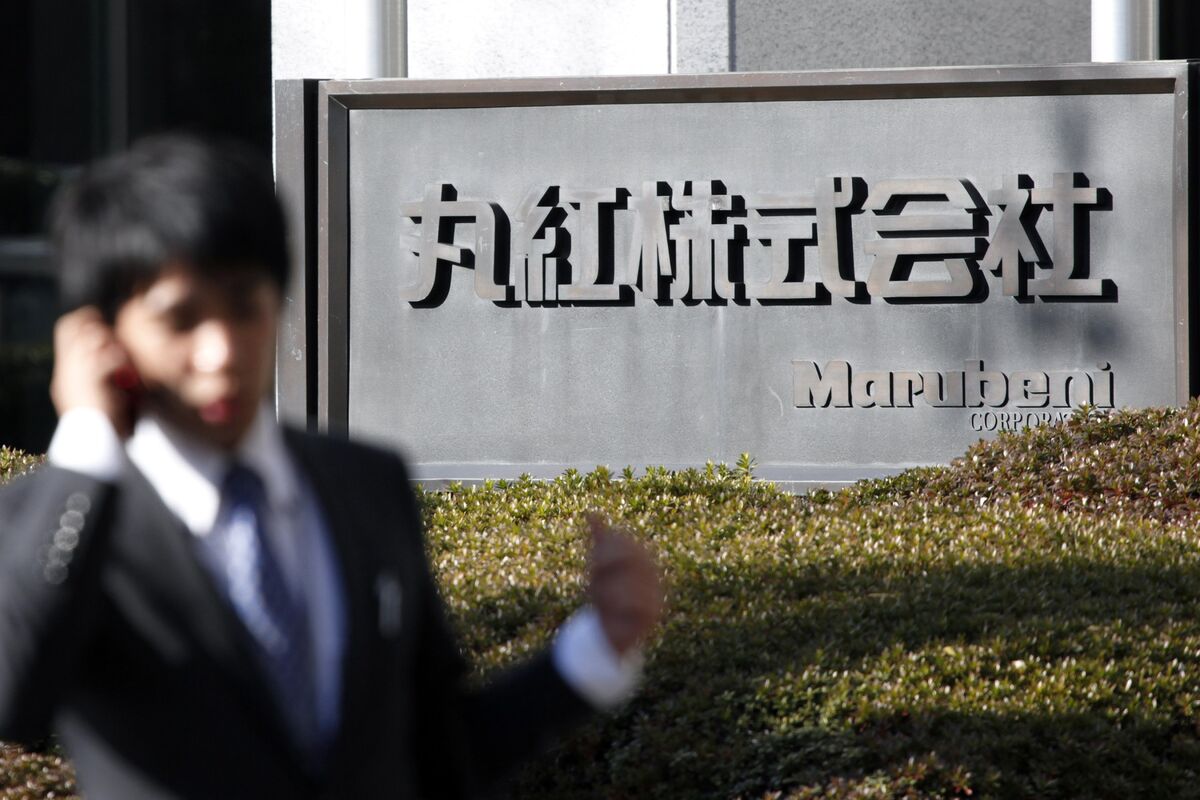

Japan’s Marubeni in Talks to Acquire Carlyle-Backed TiAuto

PositiveFinancial Markets

Japan's Marubeni Corp. is making headlines as it enters talks to acquire TiAuto Investments Ltd., which is backed by Carlyle Inc. This potential acquisition is significant as it highlights Marubeni's strategic expansion efforts in the automotive sector, showcasing their commitment to growth and innovation. Such moves can lead to enhanced market competitiveness and new opportunities for both companies.

— Curated by the World Pulse Now AI Editorial System