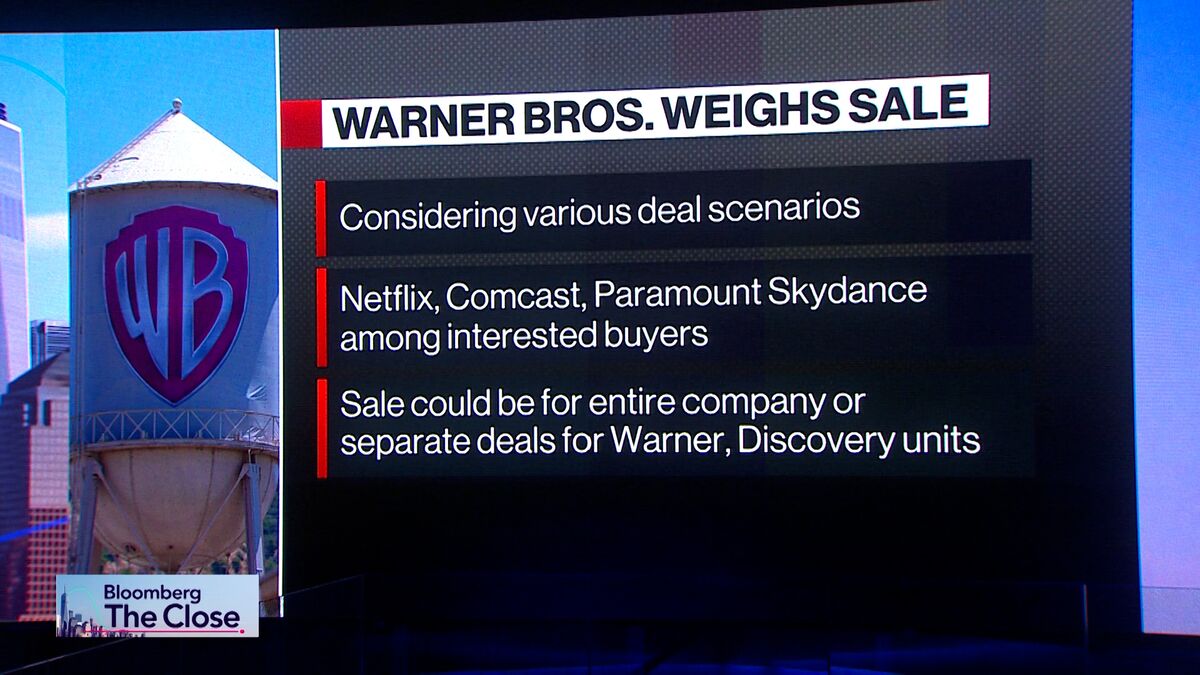

Warner Bros. confirms it’s considering a sale after ‘unsolicited interest from multiple parties,’ stock soars over 11%

PositiveFinancial Markets

Warner Bros. has announced that it is exploring a potential sale following unsolicited interest from various parties, leading to a significant surge in its stock price by over 11%. This move highlights the growing recognition of the company's valuable portfolio in the market, as noted by CEO David Zaslav. The interest from multiple parties could signal a shift in the entertainment landscape, making it a crucial development for investors and industry watchers alike.

— Curated by the World Pulse Now AI Editorial System