Japan’s Next Prime Minister Could Make Rate Increases Tricky for Bank of Japan

NegativeFinancial Markets

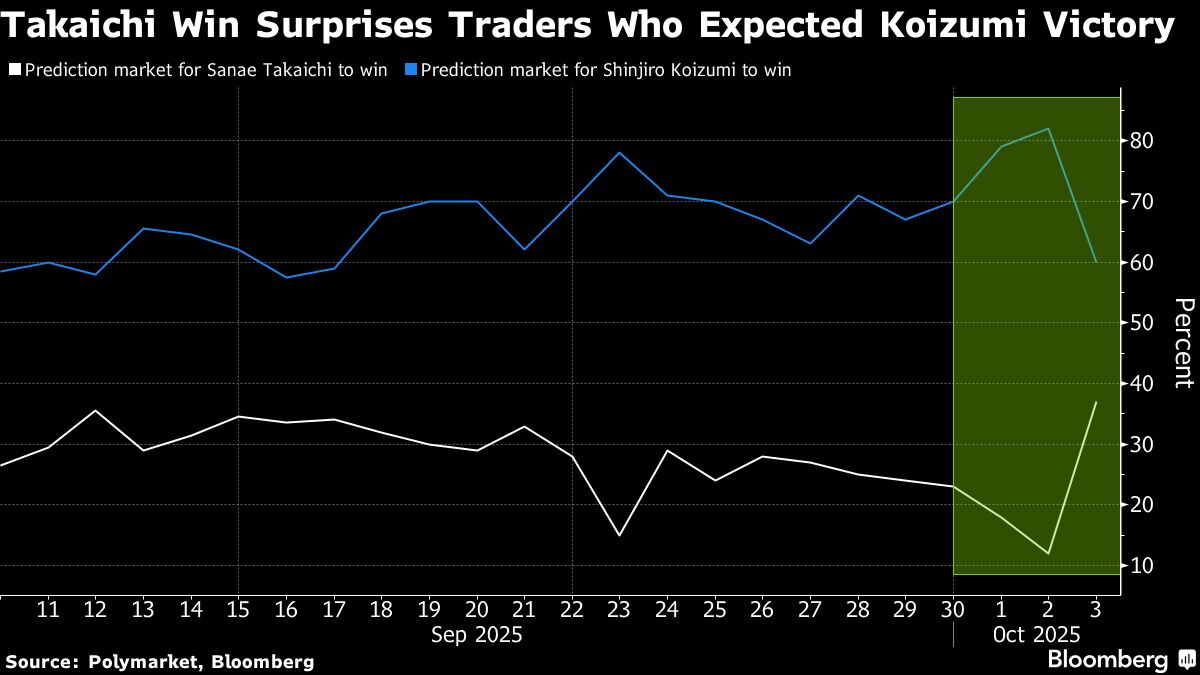

Sanae Takaichi's recent appointment as the head of the Liberal Democratic Party raises concerns about the future of Japan's monetary policy. Known for her expansionist economic views, Takaichi has previously criticized the Bank of Japan's rate hikes as 'stupid.' This could complicate the central bank's efforts to manage inflation and stabilize the economy, making it a significant issue for both policymakers and citizens.

— Curated by the World Pulse Now AI Editorial System