Asia FX, dollar steady as US govt shutdown begins; RBI decision awaited

NeutralFinancial Markets

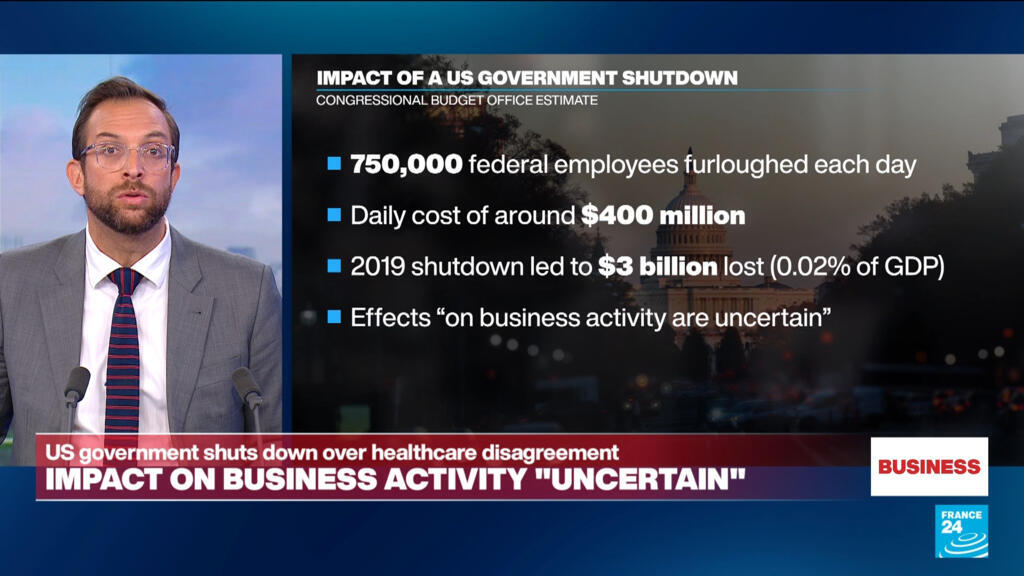

As the US government shutdown begins, the Asian foreign exchange markets remain steady, with the dollar holding its ground. Investors are closely watching for the Reserve Bank of India's upcoming decision, which could influence currency movements in the region. This situation is significant as it reflects the broader economic implications of US fiscal policies and their impact on global markets.

— Curated by the World Pulse Now AI Editorial System