Yen Slumps to Weakest Since February in LDP-Results Aftermath

NegativeFinancial Markets

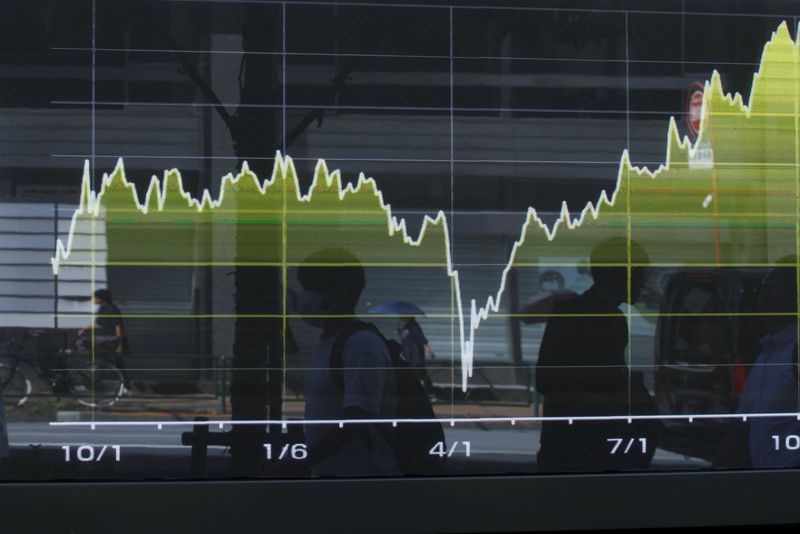

The Japanese yen has fallen to its lowest point since February, largely influenced by Sanae Takaichi's unexpected victory as the new leader of Japan's ruling Liberal Democratic Party. This decline in the yen's value against the dollar raises concerns about the stability of Japan's economy and could impact international trade and investment. As the new leadership takes shape, market reactions will be closely monitored to see how they affect the currency's future.

— Curated by the World Pulse Now AI Editorial System