Mark Zuckerberg goes all in on the AI YOLO trade

PositiveFinancial Markets

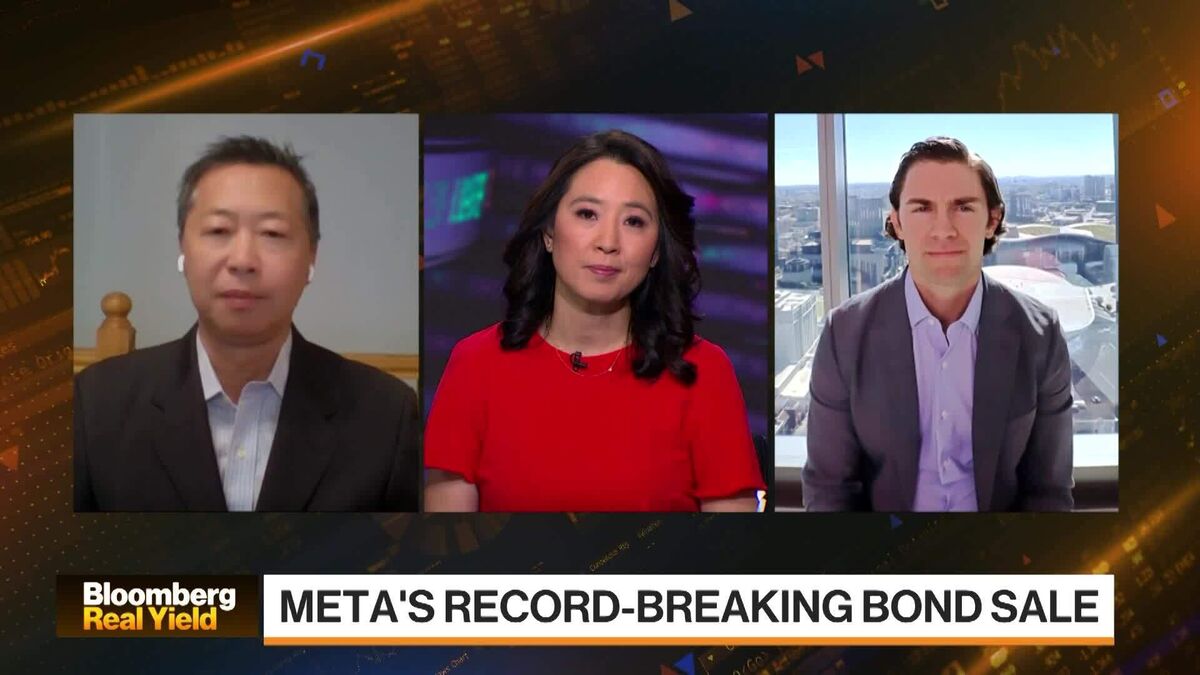

Mark Zuckerberg is fully embracing the AI YOLO trade, believing that the potential rewards of achieving superintelligence far outweigh the associated risks. This bold move by the Meta chief highlights a significant shift in the tech landscape, as companies race to harness the power of advanced AI technologies. It matters because it could redefine how we interact with technology and the future of innovation.

— Curated by the World Pulse Now AI Editorial System