Russian Oil Finds Fewer Takers in China After Hit From Sanctions

NegativeFinancial Markets

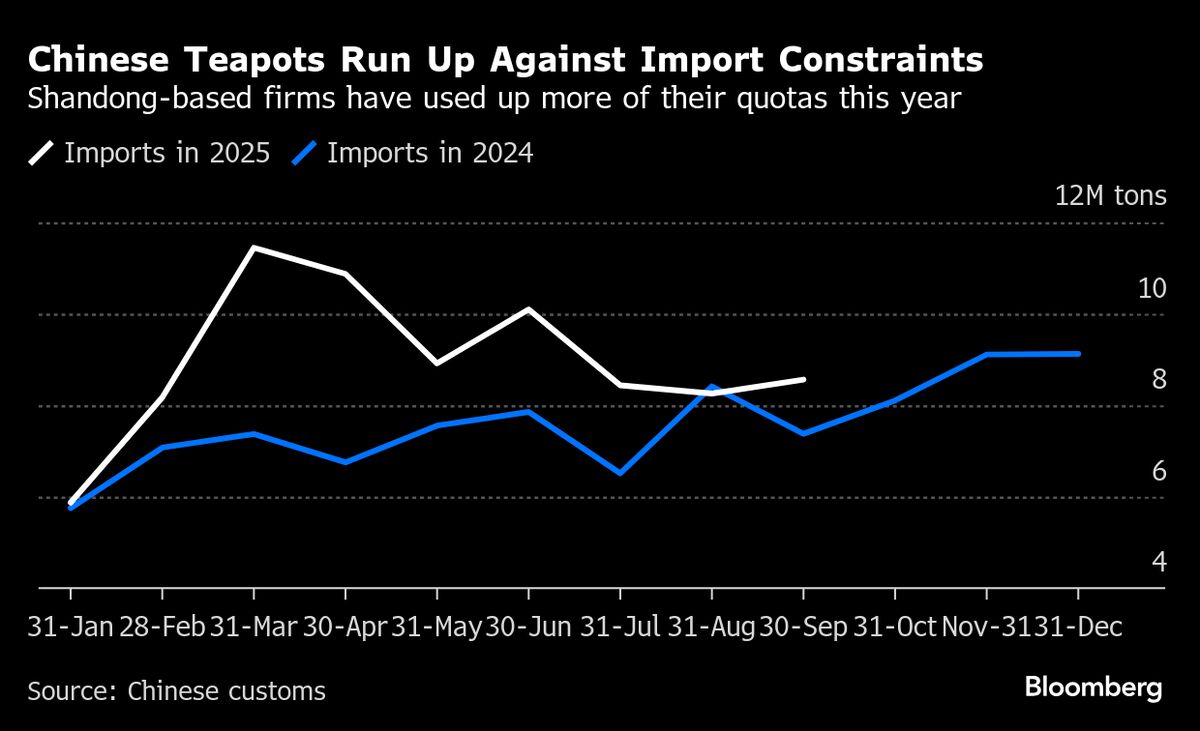

Chinese oil refiners are increasingly turning away from Russian shipments due to sanctions imposed by the US and other countries on Moscow's leading oil producers. This shift is significant as it highlights the growing impact of international sanctions on Russia's economy and its ability to export oil, which is a crucial revenue source for the country. The situation raises concerns about the stability of global oil markets and the potential for increased prices as supply chains are disrupted.

— Curated by the World Pulse Now AI Editorial System