Can a Start-Up Make Computer Chips Cheaper Than the Industry’s Giants?

PositiveFinancial Markets

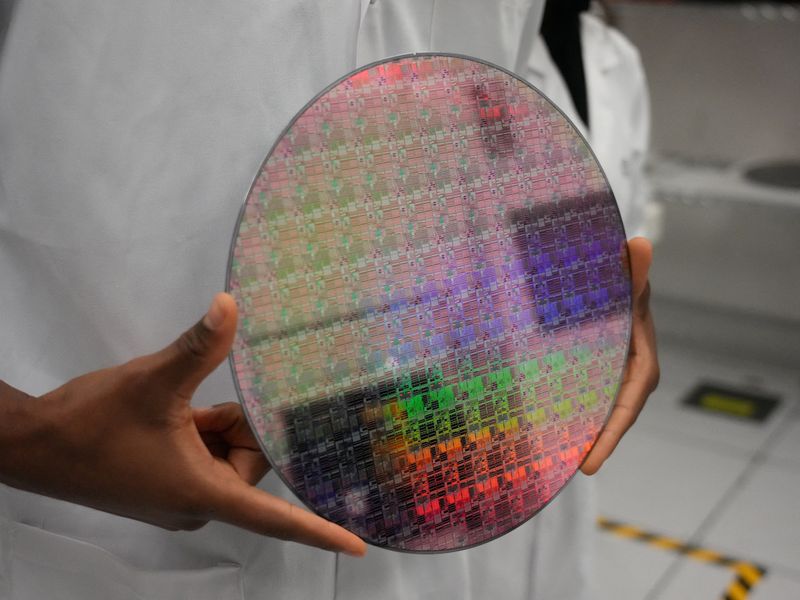

Substrate, a promising start-up based in San Francisco, is making waves in the tech industry by aiming to produce computer chips at a lower cost than established giants like ASML. This initiative is significant as it could disrupt the market, making advanced technology more accessible and potentially fostering innovation in chip manufacturing.

— Curated by the World Pulse Now AI Editorial System